William Bronchick – LLC to S Corp Conversion Kit

$97.00 Original price was: $97.00.$33.00Current price is: $33.00.

Download LLC to S Corp Conversion Kit by William Bronchick – Simplify Your Business Structure (2.92 MB). Transform your LLC into an S Corp smoothly with William Bronchick’s LLC to S Corp Conversion Kit. This course provides essential tools and step-by-step guidance to optimize your business structure for tax benefits and increased liability protection. Ideal for entrepreneurs ready to elevate their business strategy.

LLC to S Corp Conversion Kit by William Bronchick – Simplify Your Business Structure

Introduction to LLC to S Corp Conversion

Discover the strategic advantages of converting your LLC to an S Corporation with the expertly crafted LLC to S Corp Conversion Kit by Attorney William Bronchick. This comprehensive guide is designed to navigate the complexities of tax optimization for single-member LLCs and small business owners, ensuring you make the most informed decisions to benefit financially.

What Is William Bronchick – LLC to S Corp Conversion Kit?

The “William Bronchick – LLC to S Corp Conversion Kit” helps small business owners change their LLC into an S Corporation to save on taxes. This kit includes easy steps and all the forms you need. It’s good for businesses that want to pay less in self-employment taxes but keep the simple setup of an LLC. You can get this kit online and it gives you tools to make the switch without needing a lawyer or CPA. This is especially helpful for people who want to manage their business taxes better and save money.

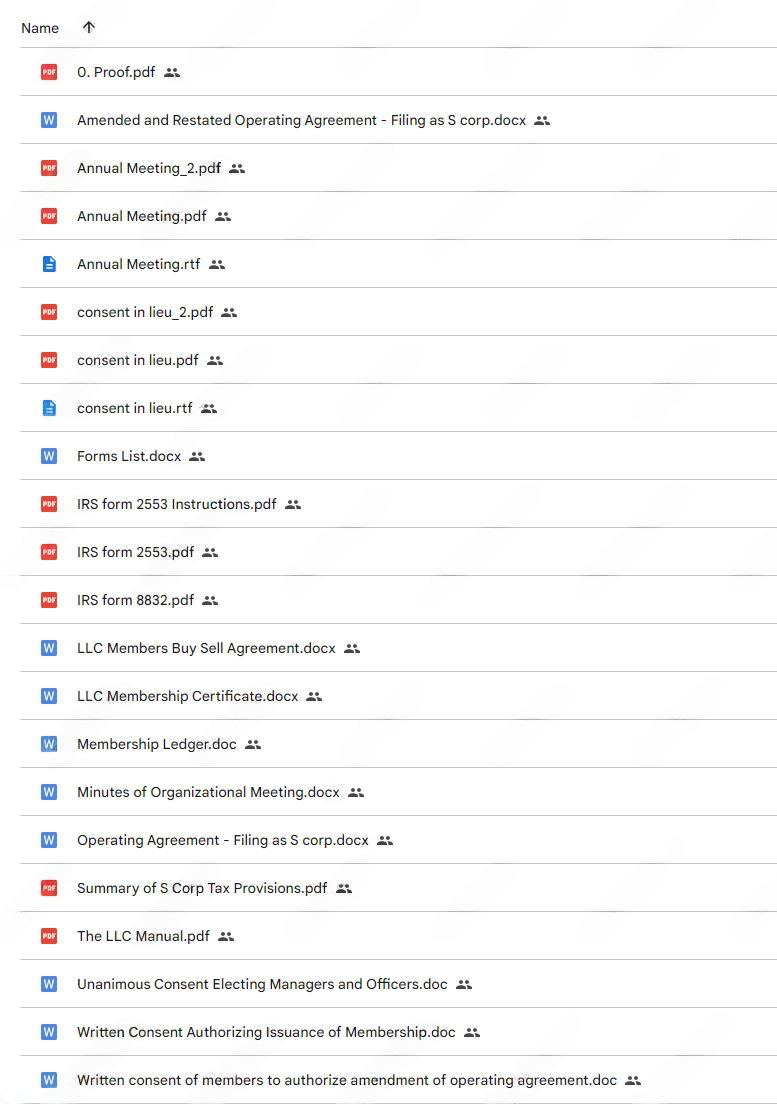

PROOF OF COURSE (2.92 MB)

WHAT YOU GET WITH THE KIT…

My downloadable kit comes complete with the following:

- The LLC operating manual

- IRS forms to choose your S corp election or change from an existing tax election

- S corp/LLC operating agreement (for either a new filing or an amended version if you are converting an existing LLC)

- Sample annual and special minutes of meetings forms

- LLC member buy-sell agreement (for LLCs with two or more members)

- Membership certificate template and membership roster form

- Minutes of organizational meeting (for new LLC/S Corp)

- Summary of S corp tax rules

- Consent in lieu of a meeting forms

- Instructions for appointing officers to your LLC (President, Secretary and Treasurer)

Why Convert?

Understanding Your Tax Status

Many small business owners start as a single-member LLC, choosing a simple tax status. But this simplicity can lead to higher taxes. Switching to an S Corporation can reduce these taxes significantly.

Benefits of an S Corporation

An S Corporation lets you pass profits to your personal tax without the extra self-employment taxes. This is ideal for businesses making $50K or more annually, offering major tax savings.

Real Estate Investors

Rental Income

Rental income typically isn’t subject to self-employment tax. But profits from flipping properties are. Using an S Corporation can protect these profits from higher taxes.

Short-term Rentals

Income from short-term rentals like VRBO and Airbnb is considered earned income and is taxed differently. An S Corporation can help save on these taxes.

How to Convert

To convert your LLC to an S Corporation, you need to:

- File the right IRS forms

- Update your operating agreement

- Set up new accounting records

You can do this without a lawyer or CPA, thanks to the clear guidance in the kit.

Who Is The LLC to S Corp Conversion Kit For?

The LLC to S Corp Conversion Kit is ideal for small business owners who have an LLC and want to save on taxes. It’s great if you’re the only owner of your business and you’re making good money, usually over $50,000 a year. This kit helps you change your business to an S Corporation, which can reduce how much you pay in self-employment taxes. It’s also useful for people who buy and sell property regularly, as it can help manage the taxes on those sales better.

Who Is William Bronchick?

William Bronchick is a well-known attorney, author, real estate investor, and public speaker. He started practicing law and investing in real estate in the early 1990s and has been involved in thousands of real estate transactions. Bronchick has authored several popular real estate books, including “Flipping Properties,” which has been recognized as one of the top ten real estate books by the Chicago Tribune. He’s also written books on financing and wealth protection for real estate investors.

FREQUENTLY ASKED QUESTIONS (FAQs)

A1: Business owners with single-member LLCs who are looking to reduce their tax liabilities on business profits should consider converting to an S Corporation.

A2: The main benefits include saving on self-employment taxes and potentially protecting your income from higher taxes and penalties in case of an IRS audit.

A3: No, the process is streamlined with the LLC to S Corp Conversion Kit, which provides all necessary forms, instructions, and templates to facilitate the conversion without the need for expensive professional help.

A4: Yes, you can maintain your LLC status for operational purposes while being treated as an S Corporation for tax purposes.

Conclusion:

The LLC to S Corp Conversion Kit by William Bronchick offers a powerful solution for LLC owners seeking to optimize their tax situation. With this kit, converting your LLC to an S Corporation is not just achievable but also manageable, providing significant tax savings and operational continuity. Equip yourself with the right tools and knowledge to transform your business’s financial health today.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet