Wall Street Prep – Financial Planning & Analysis Modeling Certification (FPAMC)

$499.00 Original price was: $499.00.$49.00Current price is: $49.00.

Download Financial Planning & Analysis Modeling Certification Course – Wall Street Prep FPAMC (10.5 GB). Achieve expertise in financial analysis with Wall Street Prep’s FPAMC – a comprehensive certification in Financial Planning & Analysis Modeling. Master budgeting, forecasting, and strategic analysis to propel your finance career forward. Enroll today and start shaping your future in the financial sector!

Financial Planning & Analysis Modeling Certification Course – Wall Street Prep FPAMC

Introduction to FPAMC: Financial Planning & Analysis Modeling Certification

The Financial Planning & Analysis Modeling Certification (FPAMC) by Wall Street Prep stands as the premier certification in the FP&A industry. This rigorous program bridges the theoretical aspects with practical application, equipping professionals with the essential tools and best practices needed to excel in the financial world.

What Is Wall Street Prep – Financial Planning & Analysis Modeling Certification (FPAMC)?

The Wall Street Prep‘s Financial Planning & Analysis Modeling Certification (FPAMC) is an online course designed for finance professionals. It teaches important skills like budgeting, forecasting, and creating financial models. The course is self-paced, meaning you can work through it on your own schedule. It typically takes about 30 hours to finish. This program is good for those who want to improve their financial planning abilities and learn practical skills for their jobs.

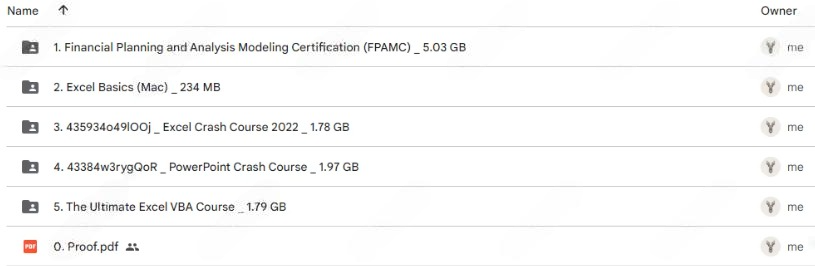

PROOF OF COURSE (10.5 GB)

The First Rigorous Certification for the FP&A Profession

Bridging the gap between theory and practice in FP&A

The FPAMC© is focused on equipping learners with actual, practical competencies and best practices in FP&A. Developed by FP&A professionals and used by finance teams from the world’s leading companies, you’ll learn how to forecast detailed operating models step-by-step, create long-range plans with built-in scenarios, and craft both short- and long-term projection models and construct data visualizations that bring numbers to life.

Job-Focused Certification Program

Solid financial modeling, data analysis and forecasting know-how is just one part of the FP&A professional’s toolbox. This challenging position also requires interpreting, visualizing and presenting data – often stepping back from modeling and data analysis to work cross-functionally to arrive at answers. The FPAMC© fills these knowledge gaps and establishes best practices for FP&A professionals.

The FPAMC© is a career-focused program designed for:

FP&A Analysts and Managers

Financial Reporting Groups

Controllers and CFOs

Accounting Professionals

Your Path to the FPAMC©

This FP&A certification course is career-focused. We begin with an overview of the FP&A career pathway, what the role entails and the systems and concepts you need to know. We move on to build an operating and forecasting model and create a long-range planning model to discuss the use of scenarios and sensitivities in forecasting. Finally, we learn how to use short-term pacing models, dynamic dashboards and data visualization to inform and influence business partners. As a bonus, we explore how to utilize advanced corporate finance principles to guide firm strategy.

Recommended Path

1 An Introduction to FP&A Week 1

2 Building the Operating Model – The Income Statement Week 2

3 Building the Operating Model – The Balance Sheet Week 3

4 Building the Operating Model – The Cash Flow Statement Week 3

5 Pulling Together the Operating Model Week 4

6 Project Management, Long-Range Planning & Analysis Week 5

7 Presentation Best Practices & Building Dashboards Week 6

8 Appendix: Corporate Finance Principles Week 6

The FPAMC© Includes the Following 8 Modules

1 An Introduction to FP&A

Module 1 of the FP&A Modeling Certification Program (FPAMC©) starts with an introduction to the FP&A role and explores the types of responsibilities typical for an FP&A professional, such as recurring reporting and accounting close, forecasting and budgeting, pacing & performance reporting, project analysis, and ad hoc analysis. We …

2 Building the Operating Model – The Income Statement

Module 2 of the FP&A Modeling Certification Program (FPAMC©). A major responsibility of the FP&A function is to come up with reasonable, defensible, and insightful expectations of future sales, expenses, and headcount requirements. Here we’ll learn the difference between fixed and variable expenses, different approaches to forecasting reven …

3 Building the Operating Model – The Balance Sheet

Module 3 of the FP&A Modeling Certification Program (FPAMC©). To support our future expectations of business performance, investments, research, and projects need to be developed and initiated today. This requires building projections around these items to determine funding requirements and future impacts on the business.

4 Building the Operating Model – The Cash Flow Statement

Module 4 of the FP&A Modeling Certification Program (FPAMC©). While projections of revenues, expenses, and capital projects can be incredibly insightful, cash flows are incredibly important for understanding the impact on company liquidity as well as its ability to finance required payments and projects. Understanding how cash flows through the …

5 Pulling Together the Operating Model

Module 5 of the FP&A Modeling Certification Program (FPAMC©). With detailed forecasts of the Income Statement, Balance Sheet, and Cash Flow Statements, we pull all three financial statements together to understand the full impact to the business. These operating models can be tailored to report on things such as fundraising and liquidity needs, …

6 Project Management, Long-Range Planning & Analysis

Module 6 of the FP&A Modeling Certification Program (FPAMC©). The beauty of well-built financial models lies not just in being building out detailed projections for the next 12-18 months, but being able to create more dynamic, long-range plans to visualize the impact that changes in these assumptions will have on the expected course of the busi …

7 Presentation Best Practices & Building Dashboards

Module 7 of the FP&A Modeling Certification Program (FPAMC©). One of the most important roles of FP&A is learning how to surface the right data, at the right time, to the right individuals, all in a format that is easy to digest. We’ll also learn how to build data lookups, dynamic charts, and output summaries while we build out a projection …

8 Appendix: Corporate Finance Principles

An Appendix of the FP&A Modeling Certification Program (FPAMC©). FP&A professionals must be able to understand corporate finance best practices, in addition to being able to build financial models. Here we’ll discuss corporate finance theory, understanding how companies fund their operations, trade-offs of debt and optimal debt ratios, fund …

Who Is The Financial Planning & Analysis Modeling Certification (FPAMC) For?

The Financial Planning & Analysis Modeling Certification (FPAMC) from Wall Street Prep is aimed at financial professionals. This includes FP&A analysts, managers, and directors. It is also useful for accountants and CFOs who want to improve their skills in financial planning. The course teaches how to make detailed financial plans and use financial data to make business decisions. It is good for those already in finance or those moving into finance who want to learn more about financial planning.

FREQUENTLY ASKED QUESTIONS (FAQs)

A1: This certification is ideal for financial analysts, financial reporting groups, controllers, CFOs, and accounting professionals aiming to enhance their financial modeling and analysis skills.

A2: Participants will learn to create detailed financial forecasts, develop long-range plans, construct various financial models, and apply data visualization techniques.

A3: The program is designed to be completed over six weeks, with each module focusing on different aspects of FP&A.

A4: While prior experience is beneficial, the program includes introductory modules that accommodate professionals new to FP&A.

Conclusion:

The FPAMC by Wall Street Prep is a definitive certification for professionals in the financial planning and analysis field, offering a blend of theoretical knowledge and practical application. Whether you are starting your career in finance or looking to enhance your existing skills, this program provides the tools and insights necessary to succeed in the dynamic world of finance.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet