Private Wealth Academy – Elite Tax Secrets

$997.00 Original price was: $997.00.$22.00Current price is: $22.00.

Download Elite Tax Strategies Course – Discover Secrets with Private Wealth Academy (1.76 GB). Discover the Elite Tax Secrets used by top professionals to legally reduce their tax liabilities. Learn how the elite navigate the complex tax system to maximize their financial freedom.

Elite Tax Secrets by Private Wealth Academy

Unlock Exclusive Tax Strategies

Discover the Elite Tax Secrets used by top professionals to legally reduce their tax liabilities. Learn how the elite navigate the complex tax system to maximize their financial freedom.

Understanding the Voluntary Tax System

Contrary to common belief, the tax system operates on a voluntary basis. Even Steve Miller, former Director of the IRS, acknowledged in a Congressional hearing that the current tax framework is not mandatory. This revelation challenges the traditional perception of taxation and opens doors to alternative financial strategies.

What is Private Wealth Academy?

Private Wealth Academy is a premier educational platform dedicated to delivering cutting-edge financial strategies for those seeking substantial wealth management expertise. With a focus on education and consultative support, the academy empowers clients—including HNWIs, business owners, and family offices—with actionable, advanced knowledge of tax strategies and wealth preservation.

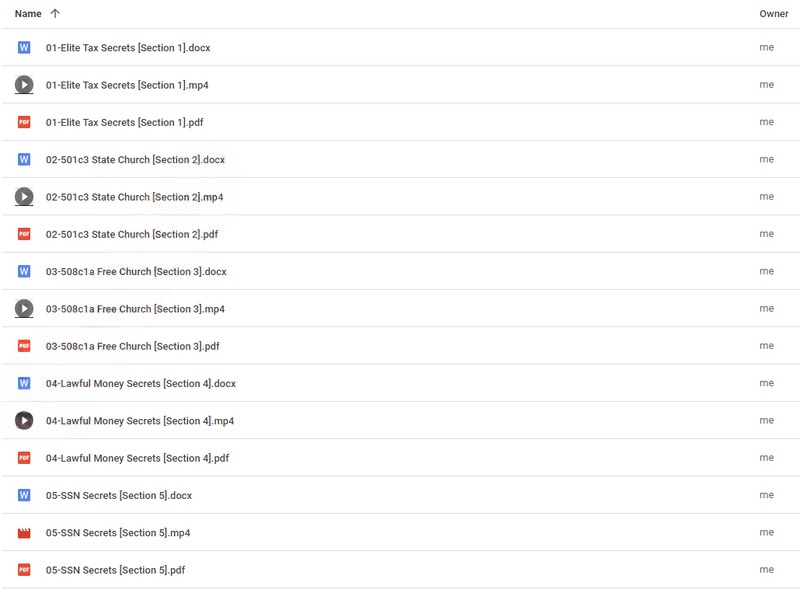

PROOF OF COURSE (1.76 GB)

Revealing the Hidden Truth About Taxes

Uncover the naked truth that has been concealed within the vast expanse of tax codes and court rulings. The solution is surprisingly straightforward, yet it has remained obscured by over 50,000 tax code sections and numerous frivolous arguments by the IRS. However, there is a proven method backed by Supreme Court rulings dating back to the early 1800s that can change your financial future.

Overcoming Tax Obligations with a J.O.B.

Even if you hold a J.O.B. that involves SSI and Withholding Taxes, there are strategies available for you. Typically, a Social Security Number (SSN) is required only for:

- Obtaining a driver’s license

- Registering a vehicle

- Handling tax matters

- Receiving public assistance

Learn how to opt out permanently from unnecessary tax obligations and regain control over your finances.

How Elite Tax Secrets Can Help You

Elite Tax Secrets provides comprehensive guidance on how to claim your redemption from the taxable event known as the income tax. Our program equips you with the truth and the knowledge to empower yourself and others around you. It’s designed to be easy to learn, ensuring you can implement these strategies effectively.

Success Stories and Case Studies

- Case Study 1: The Entrepreneur’s Path to Tax Savings

A tech entrepreneur saved 30% in taxes by restructuring income sources and optimizing deductions through Elite Tax Secrets strategies. - Case Study 2: Protecting a Family’s Multi-Generational Wealth

A family office secured wealth across generations by setting up trust structures and implementing efficient inheritance planning.

Conclusion

Empower yourself with the Elite Tax Secrets from Private Wealth Academy and take control of your financial destiny. By understanding the voluntary nature of the tax system and leveraging proven strategies, you can significantly reduce your tax burden. Join us to unlock these exclusive tax strategies and achieve greater financial freedom.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet