Danny Devan – Investing Classroom 2022

$99.00 Original price was: $99.00.$22.00Current price is: $22.00.

Danny Devan’s “Investing Classroom 2022” is a comprehensive course designed to educate individuals on investing and trading, focusing on stocks and options. With over ten years of experience in the financial markets and having founded multiple companies, Devan offers practical insights into both short-term trading and long-term investing strategies

Elevate Your Financial Literacy with Investing Classroom 2022 Led by Danny Devan

Unveil the Secrets of Smart Investing and Trading in an Interactive Learning Environment

Are you keen to demystify the complexities of the stock market? Embark on a journey with Danny Devan’s Investing Classroom 2022, a comprehensive course designed to transform beginners into savvy investors and traders. With over a decade of experience in stocks and options trading, coupled with the entrepreneurial success of launching over 12 companies, Danny has curated this course to illuminate the path for individuals eager to understand and thrive in the investing realm.

What is Danny Devan – Investing Classroom 2022?

Danny Devan’s “Investing Classroom 2022” is a comprehensive course designed to educate individuals on investing and trading, focusing on stocks and options. With over ten years of experience in the financial markets and having founded multiple companies, Devan offers practical insights into both short-term trading and long-term investing strategies

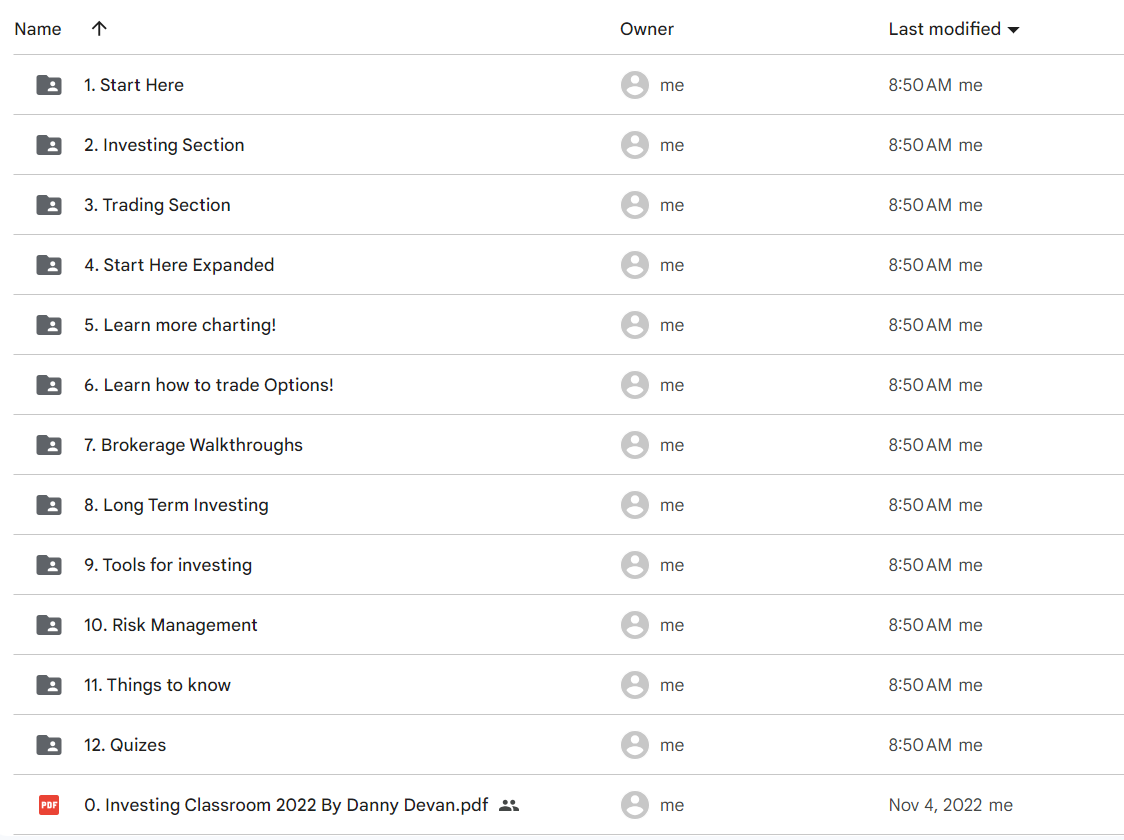

PROOF OF COURSE ( 3.89 GB).

What You Will Gain In Investing Classroom 2022?

- Comprehensive Market Understanding: From the basics of how the stock market operates to the nuances of options trading, equip yourself with knowledge applicable to real-world investing scenarios.

- Strategies for Immediate and Long-Term Gains: Discover strategies to generate daily income through trading and to build wealth over time with long-term investing techniques.

- Simplified Approach to Options: Unravel the complexities of options trading with clear, straightforward explanations and practical examples.

Interactive Classroom Experience

Engage with fellow students and participate in a dynamic learning environment. Share insights, ask questions, and learn collectively under the guidance of an expert mentor.

FAQs:

A: Absolutely! This course is tailored to guide beginners from the ground up, ensuring a solid foundation in investing and trading.

A: While the focus is on stocks and options, the principles of risk management and market analysis taught can be applied across various investment avenues.

A: Investment results can vary based on market conditions and individual application of the strategies learned. Patience and consistent practice are key.

Embark on Your Investing Journey

With Investing Classroom 2022, you’re not just learning; you’re preparing to make informed decisions that could potentially shape your financial future. Danny Devan’s mission is to demystify investing and empower you with the knowledge and tools needed to navigate the financial markets confidently.

Stocks & Options Classroom

Start Here

- Terms & Conditions (Please Read First)

- Getting Started

- Navigating Discord

- What is the stock market?

- Investing vs Trading

Investing Section (Learn how to invest first)

- ETF Investing

- My Long Term Investing Strategy

- ROTH IRA Investing

- How to buy a Stock/ETF

Trading Section (Learn how to trade next)

- Charting Indicators Explained

- Candles Explained

- Support & Resistance

- Fibonacci Explained

- Charting Patterns

- Elliott Wave Theory

- Screener

Start Here Expanded

- What is the stock market?

- Signing up for a brokerage

- Common stock terms explained

- What is economic data?

- What are futures?

- What are catalysts?

- Cash Account vs Margin Account

- How to avoid PDT and trade unlimited under 25k

- My Links

Learn more charting!

- Trading Patterns

- How to read candles

- How to draw support & resistance lines

- Best indicators to use

- How to implement stop loses

- How to read the VXX (fear gauge)

- How to trade gaps

- How to get maximum profits

- How to properly scale in and scale out

- Entries & Exits

- How to find A+ set ups

- VWAP Entries/Exits

- Moving Averages

- EMA VWAP Strategy

- How to determine if the day will be green or red

- How to find swings for multiple days/weeks

- How to know when to buy the dip

- How to trade with a small account

- When to enter a stock you believe will head higher

- Vertical & Horizontal Volume

- Finding Stocks to Trade/Invest

- My favorite Indicator that has made me the most profits

- Auto Support & Resistance

- Exponential Moving Average

- Fibonacci Lines Part 1

- Buying Premarket/After-hours

- Pinbar Lesson

- Volume Wave

- EMA VWAP Lesson Live Trading

- Elliott Waves by Julio (JulyPeppers)

- Pivot Points Tradingview

- Trading with candles

- Know when any stock makes a drastic move

- How to get over the mental number hump

- Pivot Points Thinkorswim

- Setting Alerts

Learn how to trade Options!

- What are options?

- What are options explained part 2.

- How to trade options?

- Calls and Puts explained for beginners!

- Options Strategy = Vertical Debit Spreads

- How to pick deep ITM contracts

- Beginners Vertical Debit Spread Guide

- What to look for before getting a debit spread

- Butterfly Strategy

- ITM vs OTM

- Columns/Greeks Explained

- The volatility index, playing puts continued!

- Best way to long term invest in options

- Bearish Call Credit Spreads (intermediate level)

- Intrinsic vs Extrinsic Value

- Divergences

- Iron Condor

- Bullish Put Credit Spreads

- Earnings & Options

- Selling Covered Calls (intermediate level)

- How to calculate risk/reward on spreads manually

- How to determine when to exit multi day swings

- My Favorite Trading Routine

Brokerage Walkthroughs

- Tastyworks Walkthrough

- E-trade Walkthrough

- TD Walkthrough

- Robinhood Vertical Debit Spreads

- Tastyworks Vertical Debit Spreads

- Etrade Vertical Debit Spreads

- Thinkorswim (TD Ameritrade) Vertical Debit Spreads

- Interactive Brokers Mobile Vertical Debit Spreads

- Interactive Brokers Desktop Vertical Debit Spreads

Long Term Investing

- Long term investing finding stocks

- Charting for Long Term Investing

Tools for investing

- How to follow smart money flow

- Apps and Services I am subscribed to

- Profit Tracker (helps track profits)

- How to find the best stocks before market opens!

- Backtesting Practice

- What is a golden sweep?

Risk Management

- Multiple Confirmations

- Scaling In (Dollar Cost Averaging)

- Stop Loss – Expanded

Things to know

- Do you sell at open or do you hold?

- Psychology behind trading

- Why you sell before events/earnings

- Best way to long term invest in stocks

- Setting up LLC for cheap to trade & save taxes

- Taxes when it comes to stocks

- Conclusion

- Notes

Quizes

- Beginners Quiz!

- Intermediate Quiz!

- Vertical Debit Spread Quiz!

- Risk Management Quiz

- VXX Quiz

- Buy the rumor & Sell the news

Who Is Danny Devan?

Danny Devan, through his “Investing Classroom 2022” course, brings a wealth of knowledge and experience to the world of stocks and options trading. With over a decade of investing experience and having initiated over 12 successful companies, Devan has crafted a meticulous digital course designed to guide students through the intricate world of investing. The course covers a broad spectrum of topics, from the basics of the stock market and investing versus trading to advanced strategies in options trading. Devan’s approach is to simplify complex concepts, making them accessible to both novice and experienced investors. His course aims to provide practical strategies for sustainable success in the financial markets, leveraging his vast experience and successful track record to empower learners to achieve their investment goals.

BINGCOURSE – The Best Online Courses and Learning Website

✅ Our files are hosted on PCloud, Mega.Nz, and Google Drive.

✅ We provide a download link that includes the full courses as described. Do NOT include any access to Groups or Websites!

? More Courses: Forex Trading

Q & A

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet