Paul Smith – The BASICS of Joint Venture Finance

$1,319.00 Original price was: $1,319.00.$99.00Current price is: $99.00.

Download Joint Venture Finance Fundamentals with Paul Smith (1.64 GB): Mastering Business Partnerships. Learn the basics of joint venture finance with Paul Smith’s course. Discover simple strategies to grow your business through partnerships. Ideal for entrepreneurs and investors, this course shows you how to succeed in joint ventures.

Joint Venture Finance Fundamentals with Paul Smith: Mastering Business Partnerships

Introduction to Joint Venture Finance

Joint Venture Finance is an essential strategy for anyone looking to invest in property without using their personal funds. Whether you have some capital but prefer not to deploy it, or you currently lack any financial resources, Joint Venture Finance offers a viable path to successful property investment.

What Is Paul Smith – The BASICS of Joint Venture Finance?

Joint Venture Finance is a strategic collaboration where two or more parties come together to undertake a specific business project, sharing resources, risks, and rewards. In “The BASICS of Joint Venture Finance,” Paul Smith demystifies this complex financial arrangement, making it accessible for entrepreneurs, investors, and business professionals.

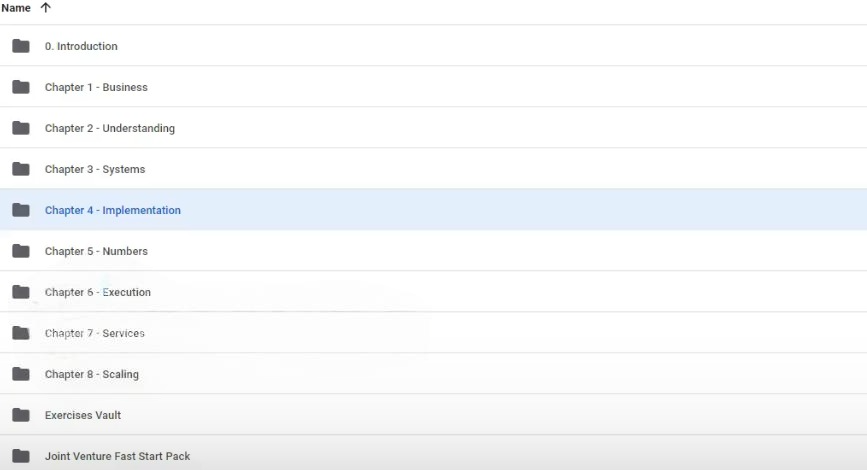

PROOF OF COURSE (1.64 GB)

Why The BASICS of Joint Venture Finance is Essential:

- Clarity and Simplicity: Paul Smith breaks down complex financial concepts into easy-to-understand language, making the book accessible to both novices and seasoned professionals.

- Practical Insights: Real-world examples and case studies illustrate key points, providing readers with actionable insights they can apply to their own ventures.

- Comprehensive Coverage: From inception to exit, the book covers every stage of a joint venture, ensuring a holistic understanding of the process.

Benefits of Joint Venture Finance

One of the primary advantages of Joint Venture Finance is the ability to access investment cash without relying solely on your own money. This approach opens up limitless opportunities for property investors by leveraging funds that are readily available when you know how to attract them effectively.

Unlocking Investment Cash with Joint Venture Finance

Many aspiring investors believe they are short of investment cash, but in reality, this resource is in abundant supply. Joint Venture Finance empowers you to tap into these funds, enabling you to expand your property portfolio significantly. Whether you already own multiple properties or are just starting out, this financial strategy can accelerate your investment journey.

Who Can Benefit from Joint Venture Finance

Joint Venture Finance is ideal for a wide range of investors. If you possess a substantial property portfolio, this financing method can help you scale your investments without additional personal capital. Conversely, if you are new to property investment, Joint Venture Finance provides the necessary financial backing to enter the market confidently.

The Role of Money in Joint Ventures

In the realm of Joint Venture Finance, money is not the sole determinant of success or failure. Instead, the crucial factor is your ability to effectively utilize other people’s money (OPM). Mastering this skill is what sets successful joint venture partners apart, ensuring that financial resources are optimized for maximum investment returns.

Who Is Paul Smith?

Paul Smith is a notable figure in the field of real estate investment, particularly known for his expertise in Joint Venture Finance. His course, “The BASICS of Joint Venture Finance,” is designed to help individuals successfully invest in property using none of their own money. This course focuses on leveraging other people’s money, a crucial skill in building a property portfolio without initial personal financial input.

FREQUENTLY ASKED QUESTIONS (FAQs)

Joint Venture Finance refers to the funding and financial management involved when two or more parties collaborate to undertake a specific business project or enterprise. Each party contributes resources, shares risks, and profits according to the terms of their joint venture agreement.

Unlike traditional financing, which typically involves securing funds from banks or investors independently, joint venture finance involves pooling resources from multiple partners. This collaboration allows for shared risk, combined expertise, and access to a broader range of financial and operational resources.

A comprehensive joint venture agreement typically includes the purpose of the venture, contributions from each party (capital, assets, expertise), profit and loss distribution, management structure, decision-making processes, duration of the venture, and exit strategies.

Yes, joint ventures are versatile and can be utilized across various industries, including technology, real estate, manufacturing, healthcare, and energy. They are particularly beneficial in sectors requiring significant investment, specialized expertise, or access to new markets.

Conclusion

Joint Venture Finance is a powerful tool for property investors seeking to grow their portfolios without personal financial risk. By understanding how to attract and leverage investment cash, you can achieve significant success in the property market. Whether you’re an experienced investor or just beginning, mastering Joint Venture Finance can transform your investment strategy and lead to enduring financial prosperity.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet