Matt Petrallia – Trading Equilibrium – Reality Based Trading

$595.00 Original price was: $595.00.$11.00Current price is: $11.00.

Matt Petrallia – Trading Equilibrium – Reality Based Trading: The Complete Swing and Position Trading Course

A Comprehensive Trading Education Based in Market Reality and Designed for Lifetime Success

Matt Petrallia – Trading Equilibrium – Reality Based Trading offers a professional trading course that focuses on developing sustainable swing and position trading strategies. This reality-based trading education cuts through market noise and complexity to deliver practical trading knowledge that keeps you profitably engaged in the markets for a lifetime.

Course Overview: What Makes Matt Petrallia’s Reality Based Trading Different

7 Hours of Professional Video Instruction

Matt Petrallia – Trading Equilibrium – Reality Based Trading includes 39 comprehensive trading videos designed for flexible, self-paced learning. Each reality-based trading lesson features:

- Bite-sized video modules for optimal learning retention

- Detailed text reinforcement that expands on video content

- Knowledge assessment quizzes to strengthen your trading foundation

- Lifetime access to all course materials and updates

Your Trading Journey: What to Expect from Reality Based Trading

Matt Petrallia’s Trading Equilibrium course recognizes that successful trading is a lifetime journey, not a quick destination. This comprehensive trading education provides:

Core Trading Competencies You’ll Master:

Foundation Building:

- Develop a repeatable trading process that leads yourself to consistent profitability

- Master swing and position trading through a comprehensive risk management lens

- Treat your trading like a business with professional systems and procedures

- Understand entry and stop dynamics for optimal trade execution

Advanced Market Analysis:

- Top-down market analysis techniques used by professional traders

- Finding relative strength in stocks and sectors for superior returns

- Strategic timing: When to get aggressive and when to play defense

- Options as a strategic tool in swing and position trading

- Spot and execute key trading setups with confidence

Professional Trade Management:

- Long and short entry patterns for complete market participation

- Trading with a full-time job: Benefits and practical methods

- Risk management strategies that protect and grow your capital

What Reality Based Trading Does NOT Promise

Matt Petrallia’s Trading Equilibrium maintains complete transparency about trading realities:

- No “secret indicators” or magical trading formulas

- No “hidden tricks” to outsmart the market

- No promises of constant profitability or overnight riches

- No proprietary systems – only proven, time-tested methods

Instead, this reality-based trading course offers veteran trader wisdom and no-nonsense trading methods that shorten your learning curve and help you develop a lifetime trading process.

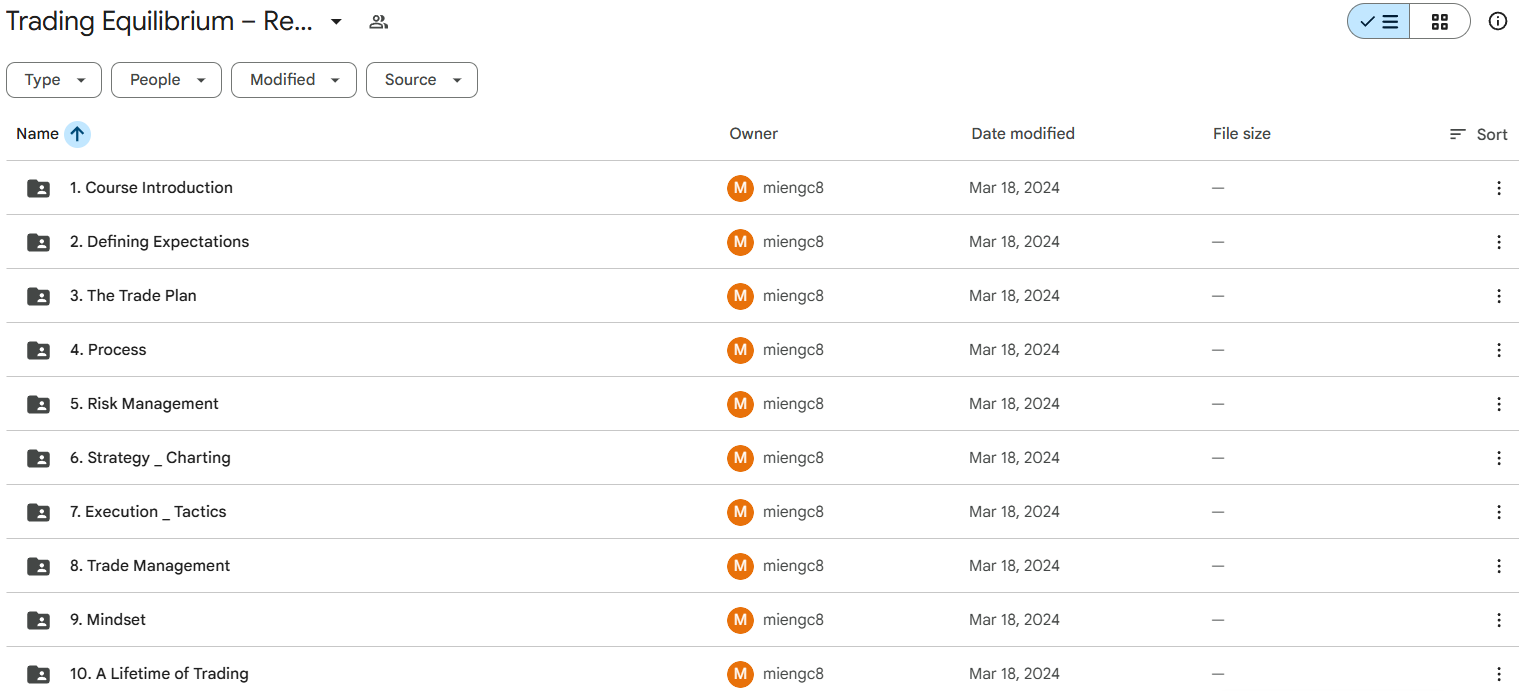

PROOF OF COURSE (7.79 GB):

Complete Course Curriculum: Matt Petrallia – Trading Equilibrium – Reality Based Trading

Module 1: Trading Fundamentals and Reality-Based Expectations

- Course Introduction and Welcome

- Universal Trading Rules every successful trader follows

- Defining Realistic Expectations for trading success

- What is Reality Based Trading? – Core philosophy and approach

- Expectations and Goals: Setting achievable trading objectives

- Simple Trading Math – Understanding probability and risk

- Swing Trading Defined – Clear goal definition and scope

- Position Trading Defined – Long-term strategy fundamentals

Module 2: Building Your Trading Business Plan

- The Comprehensive Trade Plan – Your trading business blueprint

- Writing Your Trading Plan – Foundational criteria and structure

- Process Development for consistent execution

Module 3: Market Analysis and Preparation Systems

- Monitoring the Market – Professional top-down analysis

- Stock Screening Techniques – Narrowing the trading universe effectively

- Watch List Focus – Building and managing target securities

- Daily and Weekly Routine – Professional trading habits

- Preparation vs. “Audibles” – Planned trades vs. opportunistic moves

- Trading Journal Systems – Track, analyze, and improve performance

- Trading with a Full-Time Job – Practical strategies for working professionals

Module 4: Professional Risk Management

- Risk Management Lens – Viewing every trade through risk assessment

- Different Approaches to Position Sizing – Find what works for your account

- Calculating Position Size – Precise sizing for equities and options

- Position Sizing Quiz – Test and reinforce your knowledge

- Total Open Risk Management – Portfolio-wide risk assessment

- Total Open Risk Quiz – Practical application exercises

- Sizing for Market Environment – Adapting to changing conditions

Module 5: Entry and Stop Loss Dynamics

- Situational Awareness in trade timing and execution

- Advanced Strategy and Charting Techniques

Module 6: Technical Analysis for Reality Based Trading

- Technicals vs. Fundamentals – When and how to use each approach

- Themes and Sector Strength analysis

- Top-Down vs. Bottom-Up analysis methodologies

- Price and Volume Analysis – Reading market intentions

- Moving Averages – Trend identification and confirmation

- RSI (Relative Strength Index) – Momentum and overbought/oversold conditions

- Bollinger Bands – Volatility and mean reversion strategies

- Time Frame Alignment – Multi-timeframe analysis techniques

Module 7: Trade Execution and Advanced Tactics

- Swing Trading Tactics – Short to medium-term strategies

- Position Trading Tactics – Long-term wealth building approaches

- Options as a Strategic Tool – Enhancing returns and managing risk

- Swing and Position Trading with Options – Advanced strategies

- Using Alerts – Systematic trade monitoring

- Label Trading – Organizational systems for trade management

Module 8: Specialized Trading Strategies

- DTL Compression – Advanced pattern recognition

- Breakout Strategies – Capitalizing on momentum moves

- PEAD Plays – Post-earnings announcement drift strategies

- Opportunistic Trading: “Audibles” – Adapting to market opportunities

- Short Selling – Profiting from declining markets

Module 9: Trade Management and Optimization

- The Power of Partial Profit-Taking – Maximizing winning trades

- Raising Stop Losses – Protecting profits systematically

- Defensive Selling – Recognizing when to exit

- Understanding Your Trading Bandwidth – Managing capacity and focus

Module 10: Trading Psychology and Long-Term Success

- Accepting Loss in Advance – The professional trader’s mindset

- Preparation > Prediction – Process over outcome focus

- Patience – The most valuable trading skill

- Social Media and News – Managing information and emotions

- Trading Services and Learning Curve – Continuing education

- A Lifetime of Trading – Building lasting market careers

- The Starting Line – Your journey begins here

About the Instructor: Matt Petrallia

Matt Petrallia brings over 20 years of swing and position trading experience to this comprehensive course. His qualifications include:

Professional Credentials and Experience:

- Chartered Market Technician (CMT) – Professional technical analysis certification

- 20+ years of active swing and position trading experience

- Former graduate-level instructor at NYU – Proven teaching expertise

- Continuous learner mindset – Believes learning never ends

- Passion for education – Dedicated to shortening others’ learning curves

Trading Philosophy and Approach:

Matt Petrallia’s reality-based trading methodology focuses on:

- Technical analysis expertise – Chart-based decision making

- Relative strength and weakness identification – Finding the best opportunities

- Range contraction/consolidation patterns – Optimal entry timing

- Risk-first approach – Capital preservation above all

- Business-like trading operations – Professional systems and procedures

Why Choose Matt Petrallia – Trading Equilibrium – Reality Based Trading?

Unique Value Propositions:

Lead Yourself to Success

Unlike services that ask you to follow, Matt Petrallia’s Trading Equilibrium teaches you to lead yourself to independent trading success and a lifetime in the markets.

Reality-Based Approach

No hype, no unrealistic promises – just proven trading methods and hard-fought wisdom from a 20-year trading veteran.

Designed for Working Professionals

Comprehensive strategies for trading with a full-time job, including time management and efficient market analysis.

Lifetime Learning Framework

Understanding that real progress comes from a lifetime in the market through account compounding and continuous skill development.

Risk-First Philosophy

Every strategy and technique viewed through a comprehensive risk management lens to protect and grow your capital.

Educational Excellence

Taught by a CMT charter holder with graduate-level teaching experience at prestigious NYU.

The Reality of Trading Success: Long-Term Wealth Building

Matt Petrallia’s Trading Equilibrium emphasizes the most important trading lesson: real progress and life-changing success comes from a lifetime commitment to the markets. This reality-based trading education teaches:

- Trading is not a get-rich-quick scheme – It’s a professional skill requiring dedication

- Compounding your account over time creates true wealth

- Tremendous dedication is required to excel, but the rewards extend far beyond money

- Perseverance and continuous learning are rewarded in countless life-changing ways

This comprehensive swing and position trading course provides the foundation for a lifetime trading career built on solid principles, professional risk management, and realistic expectations.

Conclusion

Matt Petrallia – Trading Equilibrium – Reality Based Trading empowers traders to lead themselves to consistent, long-term market success. This course offers practical tools, expert guidance, and structured learning to cut through noise and reduce complexity. By emphasizing discipline, risk management, and actionable strategies, it equips you with a lifetime skillset in trading—backed by a veteran trader with decades of experience and proven expertise.

Q & A

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet