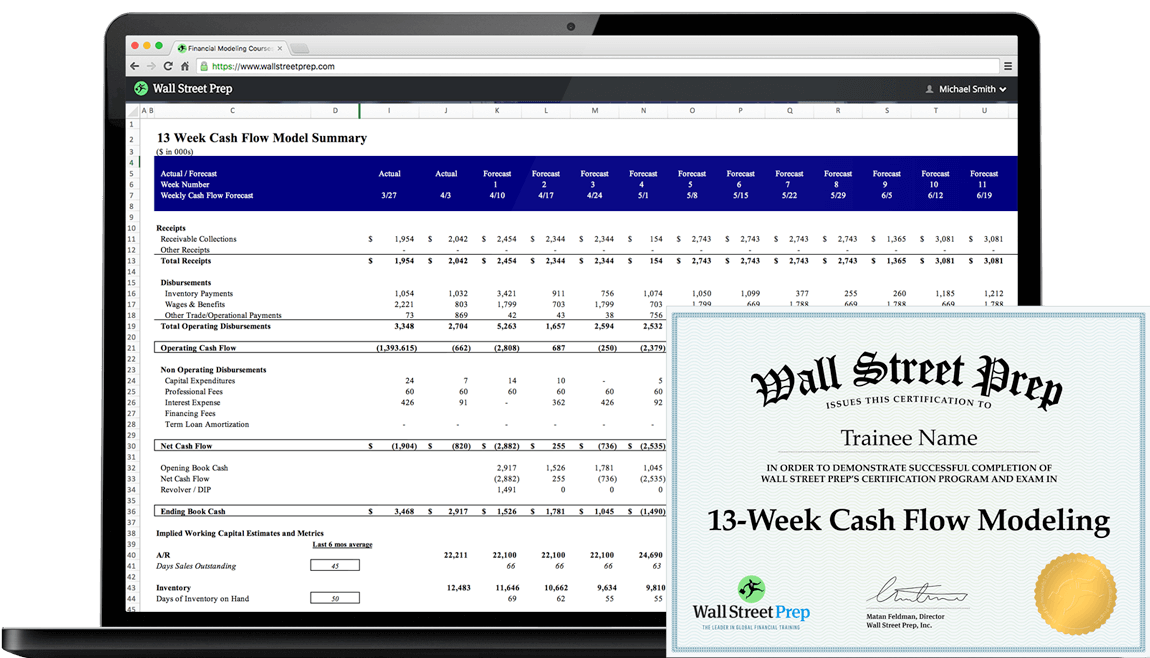

Matan Feldman – Wall Street Prep – The 13-Week Cash Flow Model

$399.00 Original price was: $399.00.$54.00Current price is: $54.00.

Download Matan Feldman – Wall Street Prep: 13-Week Cash Flow Modeling Course for Financial Mastery (1.06 GB). Boost your financial forecasting skills with Matan Feldman’s Wall Street Prep – The 13-Week Cash Flow Model course. Learn to build accurate cash flow models that predict financial health over the quarterly cycle. Ideal for finance professionals looking to enhance their strategic planning and analysis capabilities.

Matan Feldman – Wall Street Prep: 13-Week Cash Flow Modeling Course for Financial Mastery

Introduction to the 13-Week Cash Flow Model Course by Matan Feldman – Wall Street Prep

Master the art of building an integrated 13-week cash flow model with this comprehensive course by Matan Feldman from Wall Street Prep. This program is specifically designed for professionals involved in financial restructuring and turnarounds.

What Is Matan Feldman – Wall Street Prep – The 13-Week Cash Flow Model?

The 13-Week Cash Flow Model course by Matan Feldman helps you learn to manage a company’s cash during crucial times. It’s a detailed course that teaches you to predict how much money will come in and go out each week for the next 13 weeks. This is very useful for companies that need to keep a close eye on their money because they are going through tough financial times. The course uses real-life examples to show how to apply these skills. It’s ideal for people working in banking, managing investments, or in companies that are trying to fix their finances.

PROOF OF COURSE (1.06 GB)

Why you should take this cash flow modeling course?

- Complete 13-Week Cash Flow (TWCF) Training: This course is a step-by-step buildup of a fully integrated 13-week cash flow model in the context of a turnaround and financial restructuring.

- Not Just Concepts – Real World Modeling: Using a case study, you will build a fully-integrated model as you would on the job. This is the only course available that teaches complex model mechanics for a 13-week cash flow model while weaving the motivations of the various stakeholders during both in court or out of court turnarounds.

What You Will Learn From The Ultimate Project Finance Modeling Package?

- Integrated 13-Week Cash Flow Modeling

- Working Capital & Other Rollforwards

- Borrowing Base & Revolver/DIP Modeling

- Reconciling EBITDA to the 13-Week Cash Flow

- Case Manager and Multiple Scenarios

- Converting Monthly to Weekly Forecasts

- General Ledger Accounting Mapping Best Practices

Who Is The 13-Week Cash Flow Model For?

- Turnaround Consultants & Advisors

- Restructuring Investment Banking Professionals

- Distressed Debt Investors

- FP&A and Corporate Finance

- Private Equity Professionals

Wall Street Prep delivers restructuring training to some of the world’s leading turnaround consulting & advisory firms, investment banks and distressed debt funds

Course Highlights

Taught by experienced professionals

Our instructors are former finance professionals and consultants who know what it takes to build great looking decks during deals and client engagements.

The same employee training used at top firms

This is the same course our corporate clients use to teach their finance professionals and consultants how to build better pitchbooks and client decks.

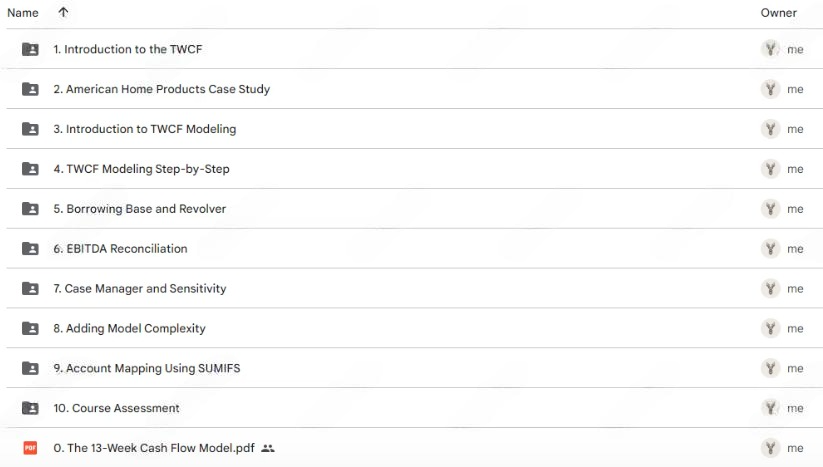

Course TOC

Introduction to the TWCF

1. TWCF Course Welcome

2. Course Downloads

3. Introduction to the TWCF

4. TWCF as a decision making tool

5. An example of a TWCF AHP

6. Non-operating disbursements

7. Lyondell’s TWCF

American Home Products Case Study

8. AHP case study introduction

9. AHP Case Study: 363 sale “Stalking Horse Bidder”

10. AHP case study: Credit bidding

11. AHP Case Study: The role of the TWCF

Introduction to TWCF Modeling

12. Introduction to TWCF modeling

13. Introducing the TWCF model case study

14. Catalyst for distress

15. Getting organized with the TWCF

16. TWCF model architecture

17. Company information provided

TWCF Modeling Step-by-Step

18. Modeling 30000 foot view

19. AR rollforward

20. Modeling disbursements

21. AR rollforward complete

22. Non-receivables receipts

23. Forecasting employee wages

24. Payroll Excel solution

25. Wages payable rollforward 1

26. Wages payable rollforward 2

27. Inventory rollforward intro

28. DOH and inventory turnover

29. Interpreting inventory KPIs

30. Building the inventory rollforward

31. Accounts payable rollforward intro

32. DPO calculation and KPI discussion

33. Building the AP rollforward

34. Forecasting inventory disbursements

35. Rent utilities other disbursements

36. Modeling other disbursements

37. Modeling non-operating disbursements

38. Capital expenditures

39. Professional fees 1

40. Professional fees 2

41. Interest payable and debt rollforwards

42. Completing the pre-revolver TWCF

Borrowing Base and Revolver

43. Borrowing base modeling

44. Borrowing base solutions

45. Revolver mechanics

46. Modeling the revolver

47. Modeling revolver interest

48. Avoiding a circularity

EBITDA Reconciliation

49. EBITDA reconciliation

50. Modeling EBITDA to cash flows 1

51. Modeling EBITDA to cash flows 2

Case Manager and Sensitivity

52. Building a case manager into a TWCF

53. Integrating cases into the TWCF

54. Sensitizing individual drivers

Adding Model Complexity

55. Most common TWCF complexities

56. Working with messy data

57. Commingled line items

58. Forecasting a Messy Monthly IS 1

59. Forecasting a Messy Monthly IS 2

60. Forecasting a Messy Monthly IS 3

61. Converting Monthly Data to Weekly 1

62. Converting Monthly Data to Weekly 2

63. Remodeling: Updating TWCF for new weeks

Account Mapping Using SUMIFS

64. Account mapping

65. Using UNIQUE to map accounts

Who Is Matan Feldman?

Matan Feldman is the founder and CEO of Wall Street Prep, a leading financial training company he started in 2004. His aim was to make it easier for professionals to enter competitive finance careers by providing engaging and practical training content. Under his leadership, Wall Street Prep has grown to become a trusted source of financial training for individuals and major financial institutions worldwide, including top firms like Goldman Sachs and JPMorgan.

FREQUENTLY ASKED QUESTIONS (FAQs)

A: This course offers a hands-on, case study-driven approach to learning, focusing on the practical application of complex cash flow modeling in a restructuring context.

A: It’s designed for finance professionals involved in restructuring, including turnaround consultants, investment bankers, distressed debt investors, and those in corporate finance and private equity.

A: You will receive a complete 13-week cash flow model template to use during the course and in your professional endeavors.

A: While the course is comprehensive, it is best suited for professionals with a basic understanding of financial modeling and restructuring processes.

Conclusion:

The 13-Week Cash Flow Model course by Matan Feldman at Wall Street Prep is a vital resource for any finance professional aiming to excel in financial restructuring and turnaround strategies. By completing this course, you will gain not only theoretical knowledge but also practical skills that are directly applicable to real-world financial challenges. Enroll today to begin your journey towards becoming an expert in cash flow modeling and restructuring.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet