Matan Feldman – Wall Street Prep – Advanced Accounting

$99.00 Original price was: $99.00.$22.00Current price is: $22.00.

Download Advanced Accounting Mastery Course with Matan Feldman – Wall Street Prep (1.32 GB). The “Matan Feldman – Wall Street Prep – Advanced Accounting” course is a comprehensive program designed for finance professionals and those aspiring to enter fields like investment banking, private equity, and corporate finance. This course aims to provide an in-depth understanding of complex accounting topics that are often encountered in the financial industry but not typically covered in traditional accounting courses.

Master Advanced Accounting with Matan Feldman at Wall Street Prep

Elevate Your Finance Career with Comprehensive Accounting Expertise

Unlock the complexities of advanced accounting with Advanced Accounting by Matan Feldman at Wall Street Prep. This course is meticulously designed to help finance professionals master challenging accounting topics through over six hours of detailed, step-by-step video instruction. Enhance your skills with real-world exercises tailored to advance your understanding and application of accounting principles in the finance industry.

What is Matan Feldman – Wall Street Prep – Advanced Accounting?

The “Matan Feldman – Wall Street Prep – Advanced Accounting” course is a comprehensive program designed for finance professionals and those aspiring to enter fields like investment banking, private equity, and corporate finance. This course aims to provide an in-depth understanding of complex accounting topics that are often encountered in the financial industry but not typically covered in traditional accounting courses.

PROOF OF COURSE (1.32 GB)

Comprehensive Course Overview

Advanced Accounting by Matan Feldman offers an in-depth exploration of intricate accounting topics that are essential for financial analysis but often overlooked in standard accounting courses. This course covers a wide range of subjects, including:

- Stock-Based Compensation

- Deferred Taxes

- Financial Instruments

- Debt Accounting

- Lease Accounting

- Mergers & Acquisitions (M&A) Accounting

Each module is packed with practical exercises that mirror real job scenarios, ensuring you gain hands-on experience and confidence in applying advanced accounting techniques.

Key Features of the Advanced Accounting Course

- Extensive Video Instruction: Over six hours of high-quality videos provide a thorough understanding of complex accounting topics.

- Real-World Exercises: Engage with practical exercises that simulate on-the-job challenges, enhancing your problem-solving skills.

- Flexible Learning Pace: Utilize 1.5x and 2x video speeds to efficiently navigate through the material at your convenience.

- Expert Instruction: Learn from former investment bankers who bring real-world context and insights to each lesson.

- Proven Curriculum: Trusted by top financial institutions and business schools to prepare analysts and associates for success.

Why Advanced Accounting Skills are Vital for Finance Careers

In the fast-paced world of finance, accounting knowledge must extend beyond the basics. Professionals in investment banking, equity research, and corporate finance require advanced skills to handle complex transactions and financial structures. This course bridges the gap by offering insights and practice with topics such as deferred taxes, stock-based compensation, and M&A accounting.

Who Should Enroll?

This advanced accounting course is ideal for professionals pursuing careers in various finance sectors, including:

- Investment Banking

- Buy-Side Equity Research

- Sell-Side Equity Research

- Private Equity

- Credit Research

- Financial Planning & Analysis (FP&A)

- Corporate Finance

Whether you’re looking to advance in your current role or transition to a specialized finance career, this course provides the expertise needed to excel.

Course Highlights

Taught by bankers

Our instructors are former I-bankers who give lessons real-world context by connecting it to their experience on the desk.

Used on the Street

This is the same comprehensive course our corporate clients use to prepare their analysts and associates.

1.5x, 2x video speed

Save loads of time by bumping up playback speed to breeze through lessons at your own pace.

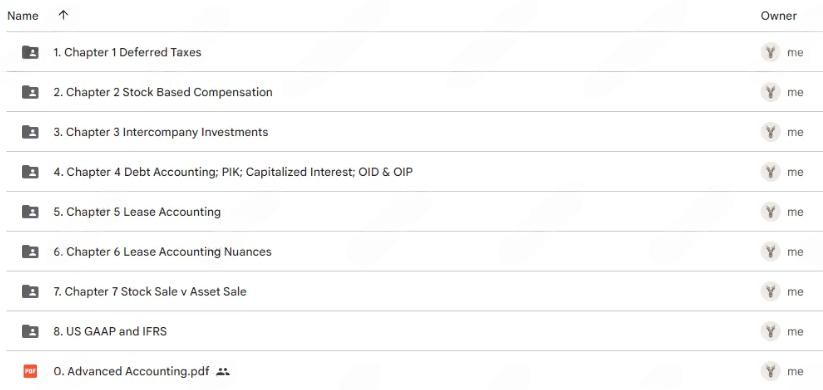

Course TOC

Chapter 1: Deferred Taxes

1. Advanced Accounting Course Welcome

2. Course Downloads

3. Introduction to Deferred Taxes

4. Deferred Tax Liabilities Exercise, Part 1

5. Deferred Tax Liabilities Exercise, Part 2

6. Book vs. Tax Basis

7. Deferred Tax Assets Exercise, Part 1

8. Deferred Tax Assets Exercise, Part 2

9. Introduction to NOLs

10. NOLs illustration

11. NOLs-related tax journal entries

12. NOLs exercise solution

13. Valuation Allowance

14. Valuation Allowance Journal Entries

15. Presentation of NOLs in Financials

Chapter 2: Stock Based Compensation

16. Stock Based Compensation

17. Stock Based Compensation Accounting: Journal Entries

Chapter 3: Intercompany Investments

18. Introduction to Intercompany Investments

19. Trading, Available for Sale & Held to Maturity Securities

20. Equity Method, Part 1

21. Equity Method, Part 2

22. Deferred Taxes & Dividends Received Deductions Arising From Equity Investments

23. Paying in Excess of Book Value Under Equity Method

24. Paying in Excess of BV Exercise

25. Consolidation Method & Noncontrolling Interests, Part 1

26. Consolidation Method & Noncontrolling Interests, Part 2

27. Consolidation Method & Paying in Excess of BV

28. Advanced Accounting Review 1

Chapter 4: Debt Accounting; PIK; Capitalized Interest; OID & OIP

29. Introduction & PIK Debt

30. Capitalized Interest

31. Original Issue Discount

32. OID Zero Coupon Exercise

33. OID With Coupon Exercise

34. OIP With Coupon Exercise

35. Debt Accounting: Financing Fees

36. Deferred Taxes Arising from OID & OIP

37. Deferred Taxes Arising from OID & OIP, Exercise 1

38. Deferred Taxes Arising from OID & OIP, Exercise 2

39. Deferred Taxes Arising from OID & OIP, Exercise 3

Chapter 5: Lease Accounting

40. Introduction to Lease Accounting

41. Lease accounting IFRS vs. US GAAP

42. Lease Presentation on the Balance Sheet

43. Operating Lease Accounting Overview

44. Exercise: Straight-Line Rent Expense

45. Exercise: ROU and Lease Liability Initial Entries

46. Imputed Interest

47. ROU Depreciation Amortization

48. Lease Liability Accounting

49. ROU Asset and Lease Liability Roll-Forward

50. Operating Lease Journal Entries

51. Finance vs Operating Lease Classification

52. Finance Lease Accounting

53. Finance Lease Roll Forwards

54. Lease Footnote Disclosures

55. Cash Flow Statement Leases Presentation

56. Lease Accounting Summary

Chapter 6: Lease Accounting Nuances

57. Impact of Lease Commencement Payment

58. Lease Liability Rollforward Walk Though

59. ROU Exercise: Operating Leases

60. ROU Exercise: Operating Leases Walk Through

61. Exercise: Finance Leases

Chapter 7: Stock Sale v Asset Sale

62. Stock Sale v. Asset Sale Intro

63. Tax Basis Step Ups in Stock sale vs Asset sale

64. Quantifying PV of Acquirer Tax Benefits in Tax Basis Step Up

65. Seller Preferences in M&A Deal Structuring

66. Calculating Target Proceeds in M&A in Asset vs. Stock Sale

67. Taxable Sales: Introduction and Acquirer Perspective

68. Taxable Sales including 338(h)(10): Target Perspective

69. NOLs in M&A

70. NOLS in M&A exercise

71. NOLs for 80%+ owned subsidiaries

72. Selling S-Corporations and subsidiaries

73. Aggregate Deemed Sales Price (ADSP)

74. Taxable Sales Exercise

75. Nontaxable Sales

76. Advanced Accounting Review 3

Core Features and Benefits

Real-World Practice and Instructor Support

- Hands-On Exercises: Each module includes exercises designed to simulate on-the-job challenges, allowing learners to directly apply their knowledge.

- Expert Instructors: Courses are taught by seasoned investment bankers who provide a professional context and share real-world examples.

- Interactive Q&A: Learners can connect with instructors for support and answers to complex accounting questions.

Flexible Learning Options

- Self-Paced Learning: Study at your own pace with options to increase video playback speed.

- Comprehensive Resources: Access to downloadable course materials, quizzes, and additional readings enhances the learning experience.

CPE Credits for Continuing Education

- Wall Street Prep is a NASBA-registered provider of Continuing Professional Education (CPE) credits, adding value for professionals seeking credentialing and ongoing education.

Expert Instructors with Real-World Experience

Our instructors are seasoned investment bankers who bring invaluable real-world experience to the classroom. By connecting theoretical concepts to practical applications on the desk, they provide a rich learning environment that bridges the gap between academia and the financial industry.

Benefits of Enrolling in Wall Street Prep’s Advanced Accounting Course

- Industry Recognition: Gain knowledge that is highly regarded by top financial institutions and business schools.

- Career Advancement: Equip yourself with advanced accounting skills that enhance your qualifications and career prospects.

- Practical Application: Apply learned concepts directly to your job, improving your performance and efficiency.

- Flexible Learning: Access course materials anytime, allowing you to learn at your own pace and schedule.

Conclusion

Investing in Advanced Accounting by Matan Feldman at Wall Street Prep is a strategic move for finance professionals aiming to deepen their accounting expertise and advance their careers. With comprehensive content, expert instruction, and practical exercises, this course equips you with the skills necessary to navigate and excel in the complex world of finance. Enroll today to master advanced accounting topics and unlock new opportunities in your finance career.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet