Macro Ops – Price Action Masterclass

$197.00 Original price was: $197.00.$12.00Current price is: $12.00.

Macro Ops – Price Action Masterclass: Complete Technical Analysis Education for Professional Traders

Comprehensive Price Action Trading Course Overview

The Macro Ops Price Action Masterclass delivers comprehensive technical analysis education through 6 detailed sections containing 26 expert-led lectures totaling over 6.5 hours of professional video content. This complete price action trading course provides traders with advanced market analysis skills and proven trading strategies used by institutional professionals.

Section 1: Prime The Pump – Mental Preparation for Trading Success

Foundation Mindset Development

- Lecture 1: A Beginner’s Mind – Master the beginner’s mindset approach essential for extracting maximum value from advanced trading education. This foundational lecture rewires your mental framework to unlock full learning potential and accelerate skill acquisition.

- Lecture 2: The “Value” In Price Action – Discover why price action analysis extends far beyond basic trade setup identification. Learn how professional price action techniques enhance risk management, emotional control, market timing, and overall trading performance.

- Lecture 3: Multidimensional Forecasting – Eliminate vague market predictions and master the components of executable trading signals. This lecture teaches quantifiable forecasting methods that create definable, actionable trading opportunities.

Section 2: Price Action Philosophy – Building Your Trading Foundation

Core Technical Analysis Principles

- Lecture 4: Simple Is Beautiful – Learn why simplified price action systems outperform complex indicator-based approaches over time. Discover how streamlined technical methods accelerate trade identification while improving performance measurement and long-term consistency.

- Lecture 5: Deathmatch: Techs Vs Fundies – Explore the technical vs fundamental analysis debate with deep insights into how professional traders integrate both approaches. Understand why successful operators ultimately become “slaves to the tape.”

- Lecture 6: Probabilistic Trading Mindset – Develop realistic expectations about trading probability and market uncertainty. This lecture uses poker analogies to shift mindset from prediction-based to probability-based trading, essential for long-term success.

- Lecture 7: Sturgeon’s Law: 90% Of Everything Is Crap! – Master the art of high-quality trade selection by avoiding mediocre setups. Learn to identify and trade only within pockets of market clarity for improved win rates.

- Lecture 8: Market Randomness Reality – Confront the quasi-random nature of markets head-on. Unlike most technical courses, this lecture provides mental frameworks for dealing with market randomness while maintaining trading confidence.

Section 3: Advanced Charting – Strategic Market Analysis

Professional Chart Reading Techniques

- Lecture 9: Reading Price Is Reading Emotions – Understand how price charts map investor emotions and why price action systems work. This psychological insight builds confidence in technical trading methods.

- Lecture 10: The Two Faces Of Price: Consolidation and Trend – Develop a complete mental model of price behavior. Master the fundamental concept that price only trends or consolidates, simplifying complex market analysis.

- Lecture 11: Trend Structure Deconstruction – Deep dive into trending market behavior that master speculators have exploited for billions in profits. Learn the theory and structure behind profitable trend trading.

- Lecture 12: Fractal Market Analysis – Apply fractal geometry principles discovered by Benoit Mandelbrot to reconcile multi-timeframe price movements for enhanced market perspective.

Section 4: Quantitative Analysis – Data-Driven Trading Decisions

Mathematical Market Modeling

- Lecture 13: The Random Walk – Understand how quantitative analysts model markets and where traditional models break down. Learn the binomial model as an intuitive approach to market randomness.

- Lecture 14: Noise Vs Signal: Market Efficiency – Quantify market tradability using the efficiency ratio. Learn why some markets are harder to trade and how to identify optimal trading conditions.

- Lecture 15: Momentum and Mean Reversion Forces – Master quantitative price categorization across multiple timeframes. Learn to exploit momentum and mean reversion forces by identifying market dominance patterns.

- Lecture 16: Volatility Analysis Mastery – Integrate volatility analysis into price action systems. Understanding volatility conditions often determines technical signal success more than price direction itself.

Section 5: Macro Ops Market Lens – Profitable Trading Execution

Professional Pattern Recognition

- Lecture 17: Target, Deploy, Profit – Learn the Macro Ops classical charting approach with comprehensive pros and cons analysis for professional market analysis.

- Lecture 18: Classical Chart Pattern Mastery – Master all classical chart patterns used for trade execution. Avoid “Rorschach analysis” by focusing only on crisp, clear pattern setups.

- Lecture 19: Perfect Entry Techniques – Distinguish between mediocre and perfect trade entries. Analyze quality breakout bars, breakout failures, and retrace entry strategies.

- Lecture 20: Pattern Evolution and Failure – Understand why chart patterns morph and fail, setting proper expectations and avoiding unfavorable market conditions for pattern trading.

- Lecture 21: Multi-Timeframe Analysis – Master timeframe selection and multi-timeframe analysis to uncover highly profitable “nested” patterns with optimal stability and efficiency.

- Lecture 22: Asset Class Nuances – Adapt price action analysis to different asset classes. Learn why fixed income, commodities, and equities each require tailored technical analysis approaches.

- Lecture 23: Professional Market Scanning – Get insider access to Macro Ops market scanning techniques for identifying high-probability trading opportunities.

Section 6: Advanced Trade Management – Profitability and Emotional Control

Professional Risk Management

- Lecture 24: Graceful Exit Strategies – Master trade exit techniques for both winning and losing positions. Learn comprehensive exit strategies that maximize market edge and profitability.

- Lecture 25: Probability Mutation – Understand how stop loss and target placement dramatically influence win rates. Learn to calculate theoretical breakeven rates and adjust systems for optimal psychological fit.

- Lecture 26: Bayesian Inference in Trading – Apply advanced Bayesian inference techniques used by master traders to adjust existing positions as new market information becomes available.

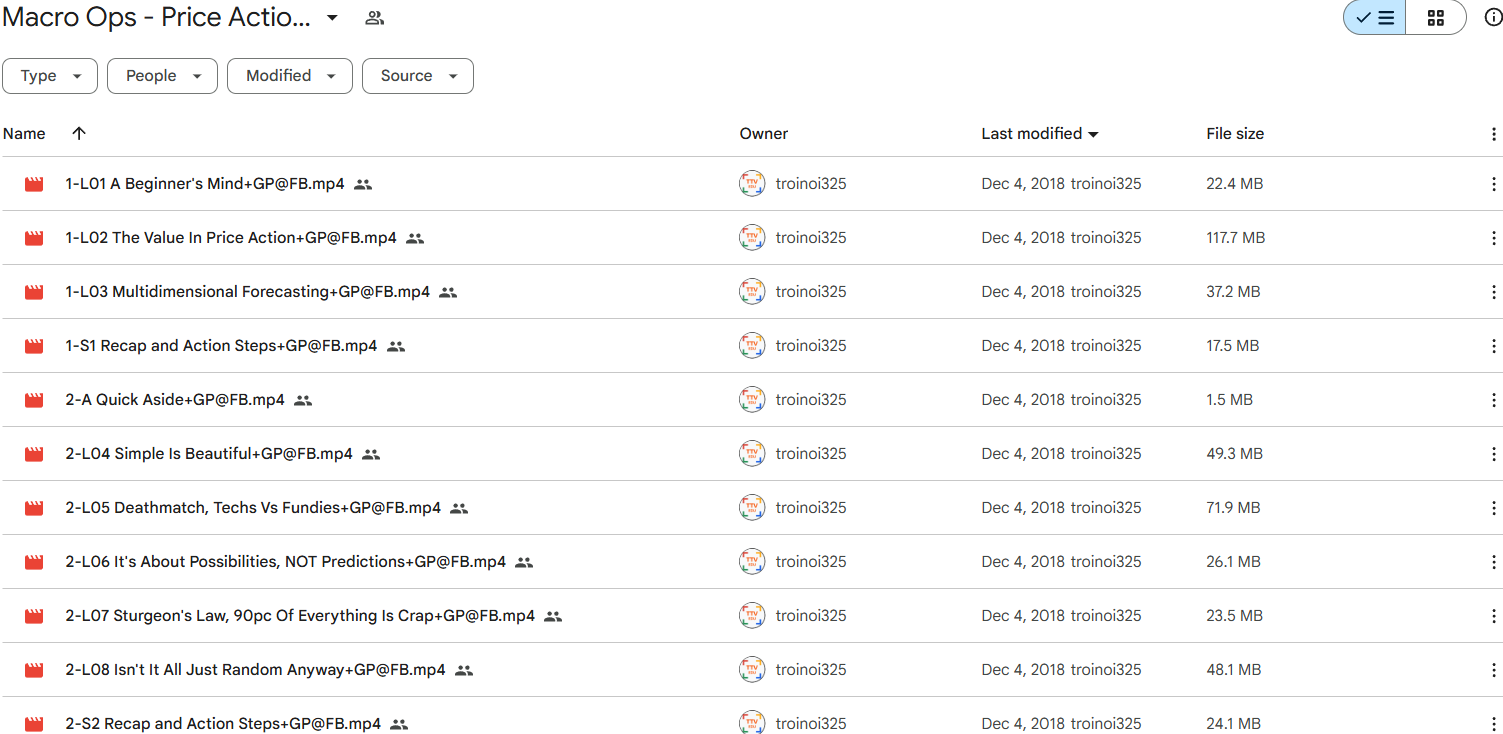

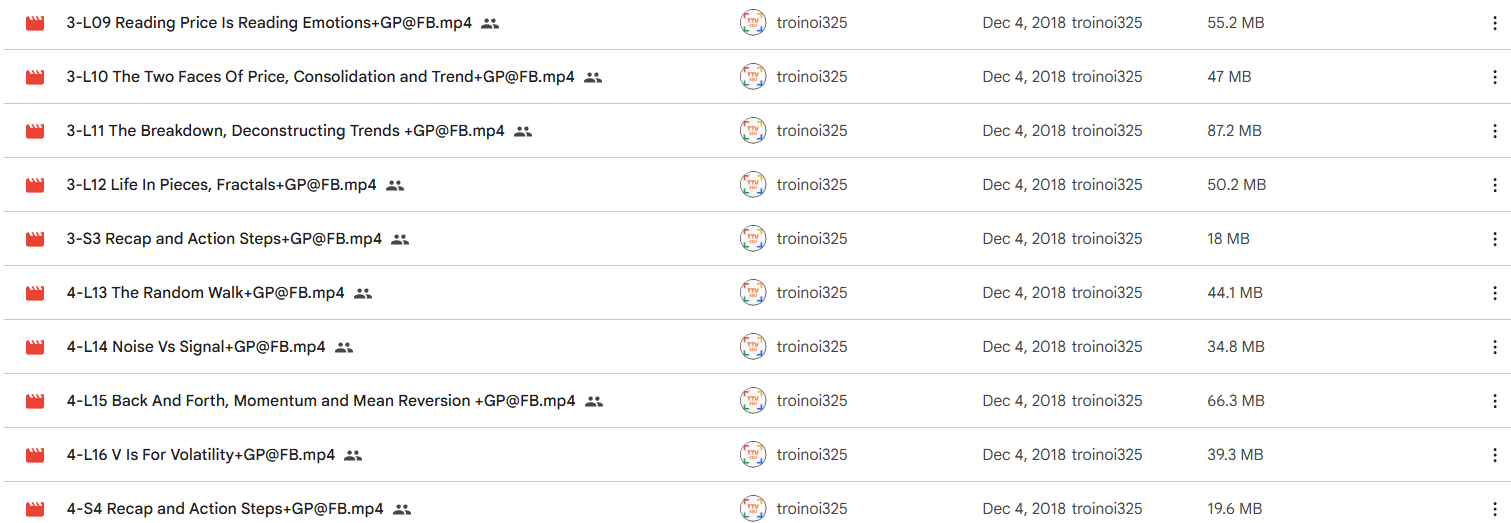

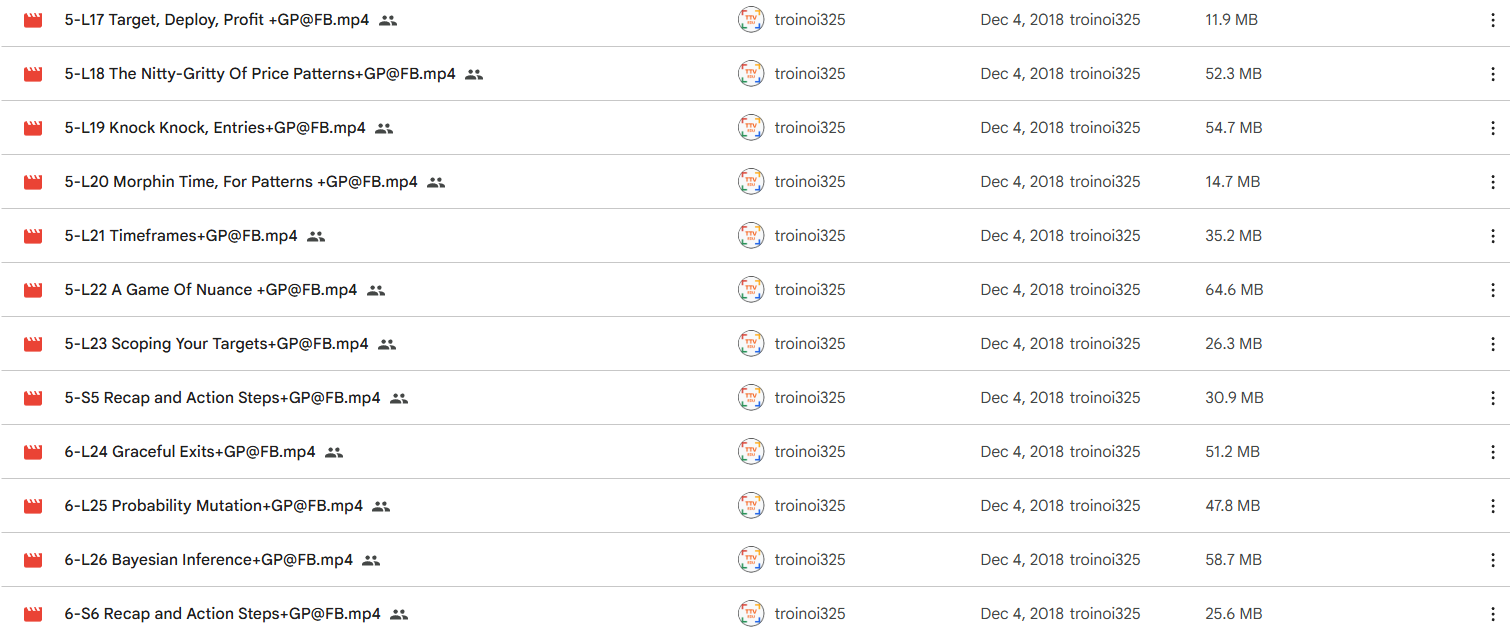

PROOF OF COURSE (1.34 GB):

Why Choose Macro Ops Price Action Masterclass?

Expert-Led Technical Analysis Education

This comprehensive price action course combines institutional-level trading education with practical application. The curriculum covers everything from foundational trading psychology to advanced quantitative analysis, making it suitable for both developing and experienced traders seeking professional-grade technical analysis skills.

Proven Trading Methodology

The Macro Ops approach emphasizes classical charting patterns, multi-timeframe analysis, and quantitative market modeling – techniques used by successful institutional traders and hedge fund professionals.

Who Should Enroll in the Price Action Masterclass?

The Macro Ops – Price Action Masterclass is designed for traders and investors who are committed to developing a deep, actionable understanding of price action trading. This course is ideal for individuals seeking to enhance their technical analysis skills and achieve consistent profitability in the markets.

Conclusion: Transform Your Trading with Professional Price Action Mastery

The Macro Ops Price Action Masterclass stands apart as a complete technical analysis education that bridges the gap between academic theory and practical trading application. With 6.5+ hours of expert instruction across 26 comprehensive lectures, this course delivers the professional-grade price action skills needed for consistent market success.

Key Differentiators:

- Institutional-level curriculum covering psychology, methodology, and execution

- Quantitative approach to market analysis often missing from traditional technical courses

- Multi-timeframe pattern recognition techniques for enhanced trade identification

- Advanced trade management and Bayesian inference applications

- Real-world market scanning and asset class adaptation strategies

Whether you’re developing foundational technical skills or advancing existing knowledge, this comprehensive price action masterclass provides the depth, expertise, and practical application necessary for professional trading success.

Q & A

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet