Kathleen Di Paolo – Global Tax Strategy Design

$1,997.00 Original price was: $1,997.00.$29.00Current price is: $29.00.

Download Global Tax Strategy Design Course by Kathleen Di Paolo – Comprehensive International Tax Planning (13.8 GB). Unlock the secrets of efficient global tax planning with Kathleen Di Paolo’s Global Tax Strategy Design course. Learn to navigate complex international tax laws, optimize tax structures, and enhance your organization’s financial performance. Ideal for finance professionals aiming to excel in global markets.

Global Tax Strategy Design by Kathleen Di Paolo

Ultimate Tax Plan for Location Independent Entrepreneurs

Are you a location independent entrepreneur looking for the best tax plan? Kathleen Di Paolo, an international tax expert, offers the Global Tax Strategy Design tailored just for you.

What Is Kathleen Di Paolo – Global Tax Strategy Design?

Kathleen Di Paolo – Global Tax Strategy Design” is an online course designed to help you understand and build effective tax strategies. It aims to legally reduce how much tax you pay and increase your returns. The course is structured into clear, easy-to-follow steps, including video lessons that guide you through the whole process.

What Is Global Tax Strategy Design?

Global Tax Strategy Design is a specialized area within tax consulting that focuses on creating comprehensive tax plans for individuals and businesses operating across multiple countries. The primary goal is to minimize tax liabilities while ensuring full compliance with the diverse tax laws and regulations of different jurisdictions.

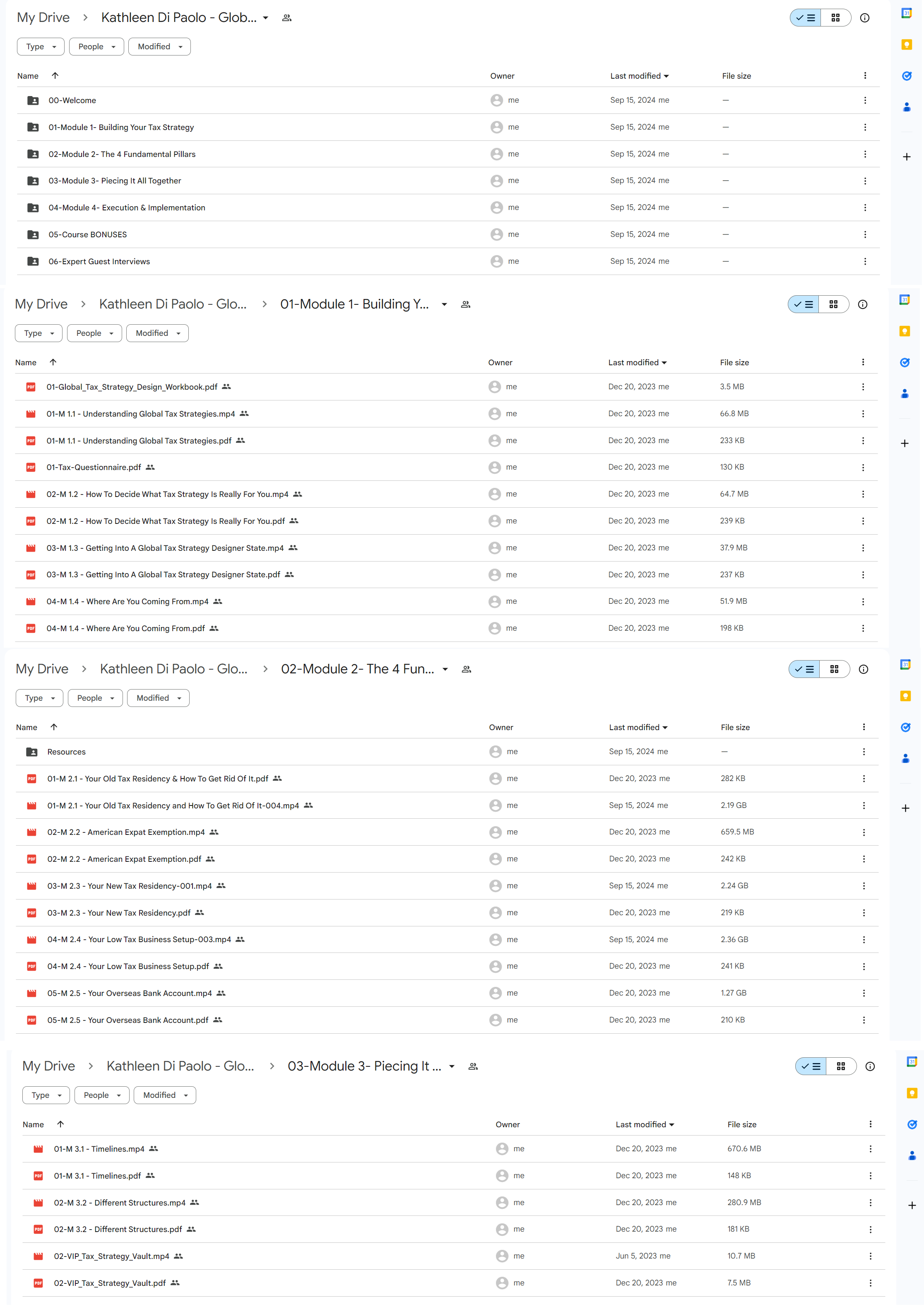

PROOF OF COURSE (13.8 GB)

Create a Tax Strategy in Just 5 Days

Imagine having a tax strategy that legally reduces your taxes in only 5 days! Unlike generic solutions from websites, our tax strategies are carefully designed step-by-step to fit your unique needs.

4 Key Pillars of a Smart Tax Strategy

To legally lower your taxes, every tax strategy must include these 4 key pillars:

- Incorporation Strategy

- Tax Residency Planning

- Bank Account Optimization

- Compliance and Legal Structuring

Learn how these pillars can remove confusion and stress from your tax duties and set up your business in a tax-friendly country.

Success Stories from Happy Entrepreneurs

Join many entrepreneurs who have improved their tax plans:

- “I now feel confident that I’m compliant AND smart about my taxes.”

- “After struggling for a year, I finally know which strategy to use to pay less taxes.”

- “I didn’t know ANYTHING about taxes, but now I feel very educated!”

Why Paying Too Much Tax is Costly

Paying too much tax can hurt your location-independent lifestyle and slow your business growth. Whether you’re just starting or already earning six figures, remember:

Taxes do not lower themselves! You need a custom tax structure that matches your business goals and personal lifestyle.

Avoid Common Tax Strategy Mistakes

Many online entrepreneurs make these big mistakes:

- Copying Others’ Structures: This can lead to non-compliance and higher taxes.

- Using Simple Structures: Sole proprietorships may not be the best choice, resulting in unnecessary tax payments.

Instead, invest in a professionally designed tax strategy to maximize your savings and ensure compliance.

Comprehensive Online Course for Tax Strategy Design

Introducing the Simple Step-By-Step Online Course for creating your smart tax strategy:

- Detailed Video Training: Learn how to build the 4 key pillars.

- Blueprints and Examples: Proven tax strategy examples to guide you.

- Scenarios and Options: Make compliance and risk management easy.

Module Breakdown: Master Your Tax Strategy

Module 1:

Building Your Tax Strategy

The 4 Fundamental Pillars of a Smart Tax Strategy

Every great recipe is made up of a list of ingredients… take a cake for example! Forget even one ingredient (like the sugar) and the cake is ruined! That’s how the tax strategy for you and your business works!

Inside Global Tax Strategy Design, you won’t just get a list of the 4 ingredients required to cook up an optimized tax strategy. You’ll get step-by-step training walking you through exactly how to NAIL each pillar without having to take 10 tax courses!

Imagine how much easier and fun it will be to build your tax strategy when you can simply follow the step-by-step guides and proven examples for each section!

The 4 “Ingredients” of Money-Saving Tax Strategies:

Below is a Sneak-Peak at ALL 4 Required Pillars That You’ll Create inside Global Tax Strategy Design:

You’re not just getting the “recipe,” I’m giving you everything You need to build, Design, Understand & Set up Your Tax Strategy TOO!

Module 2:

Uncovering Tax Fundamentals

How the Pro’s Save Taxes!

Get inside my brain! When you’ve been building hundreds of tax strategies and corporate structures for entrepreneurs in numerous industries, how much will it help to get inside my brain and see exactly how I approach a set up and why it’s so different than most?! In this section…

I’ll Reveal the Invisible Elements Beneath the Surface That Creates Powerful Tax Strategies!

you’ll discover…

- MY UNIQUE APPROACH TO LOWER YOUR TAXES!

Including: what I look for, what questions to ask, and how to know you have a great tax-saving opportunity in front of you before you even start! - HOW VITAL YOUR

current situation and future plans are to actually minimize your taxes! - THE REAL TRUTH ABOUT

“OFFSHORE SOLUTIONS” and how to accurately stay compliant. - THE ART OF DESIGNING TAX STRATEGIES

to optimize your unique circumstances and build a solid structure… even if you’re like me and keep moving from country to country.

…AND MORE!

Module 3:

Tax Strategy For The Tax Newbie

“It’s not just enough to design a Thousand Dollar Tax-Saving Strategy… it’s gotta tick all the requirements too, right?!”

Today, tax havens and offshore companies on a Caribbean island will quickly raise flags with not only tax offices but also with your clients.

Think about it! What’s your first impression about a business that is incorporated in the Cayman Islands or the British Virgin Islands?

So, 80s? Outdated? Amateur? Fake?

Is that how you want people to think about you and your business? Of course not!

So how do you create reputable, professional-looking, effective tax strategies without breaking the bank with an overpriced offshore provider?!

Inside Global Tax Strategy Design, I walk you through…

- Simple-to-follow tax strategy elements anyone can learn to “spruce up” their compliance.

- How and where to hire reliable accountants for online businesses!

Module 4:

How To Execute & Operate Your Tax Strategy

The last thing you need is the “World’s Greatest Tax Strategy” sitting on your desktop collecting dust. Until it gets executed and operational, it won’t ever do anything to help you minimize your taxes!

That’s Why I’ve Included an Entire Step-by-step Tax Strategy PROCESS for Executing and Operating Your Strategy Without a Fancy Compliance Team or Accounting Skills!

If you can follow directions, you can execute your tax strategy and run it efficiently while saving thousands in taxes!

“This is Great Kathleen!

…But What IF I’m still at the beginning of my journey as an entrepreneur?!”

This is about the time where you might be saying, “Ya Kathy, but I don’t even have a thriving business. Shouldn’t I focus on that first?” NO.

Why Creating Your 6-figure Business BEFORE You Create a Tax Strategy is BACKWARDS!

Most entrepreneur newbies put their heart and soul for months, if not years, to create a successful business that will give them freedom. THEN… at the end of the tax year, they realize that they owe the taxman almost half of what they’ve made. Sound familiar?

…but how do you even know how much money you’re going to owe to the taxman?!

(that’s a lot of speculation, and uncertainty that I wouldn’t risk wasting time on, would you?)

When you create your tax strategy first, it’s focused on matching your future vision and desire to grow your business… what you already want!

…and then you create the tax strategy that matches that!

Every successful entrepreneur I’ve known always makes sure to build a solid tax strategy at the beginning

of their entrepreneurial journey so they can shift their focus on the business. If not, it’s going to be a battle to constantly juggle the growth of your business while back paying the taxman.

How to Learn More About Kathleen Di Paolo

For detailed and specific information about Kathleen Di Paolo and her expertise in Global Tax Strategy Design, consider the following steps:

- Official Website: Visit her professional or company website for comprehensive details about her services, experience, and client testimonials.

- Professional Profiles: Check platforms like LinkedIn for her professional background, endorsements, and network connections.

- Contact Directly: Reach out via email or phone for personalized inquiries and consultations.

- Publications and Talks: Look for any articles, whitepapers, or speaking engagements she may have participated in to gain insights into her expertise and perspectives.

Start Your Tax Strategy Early

Creating a tax strategy at the start of your entrepreneurial journey ensures:

- Alignment with Business Growth: Focus on growing your business without tax worries.

- Financial Clarity: Know your tax duties and plan to avoid surprises.

Conclusion:

Don’t let high taxes hold back your business growth and location-independent lifestyle. With Global Tax Strategy Design by Kathleen Di Paolo, you can legally reduce your taxes, maximize your savings, and build a strong foundation for your success.aching.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet