Karlton Dennis – Tax Strategy Crash Course

$497.00 Original price was: $497.00.$19.00Current price is: $19.00.

Download Master Tax Planning & Optimization: Karlton Dennis’ Comprehensive Tax Strategy Crash Course (217 MB). Boost your financial savvy with Karlton Dennis’s Tax Strategy Crash Course. Learn expert techniques to maximize deductions, minimize liabilities, and enhance your strategy.

Master Tax Planning & Optimization: Karlton Dennis’ Comprehensive Tax Strategy Crash Course

Tax Strategy Crash Course By Karlton Dennis

Welcome to the Tax Strategy Crash Course, your comprehensive step-by-step video training guide designed to elevate your understanding of taxes. Whether you’re a W-2 employee or a 1099 contractor, this course equips you with the essential strategies to optimize your tax situation effectively.

What Is Karlton Dennis – Tax Strategy Crash Course?

The Karlton Dennis Tax Strategy Crash Course is designed to educate individuals and businesses on effective tax strategies to optimize tax savings and ensure compliance with tax laws. This comprehensive course covers a broad spectrum of topics, ranging from basic tax fundamentals to more advanced strategies for reducing tax liabilities and preserving wealth.

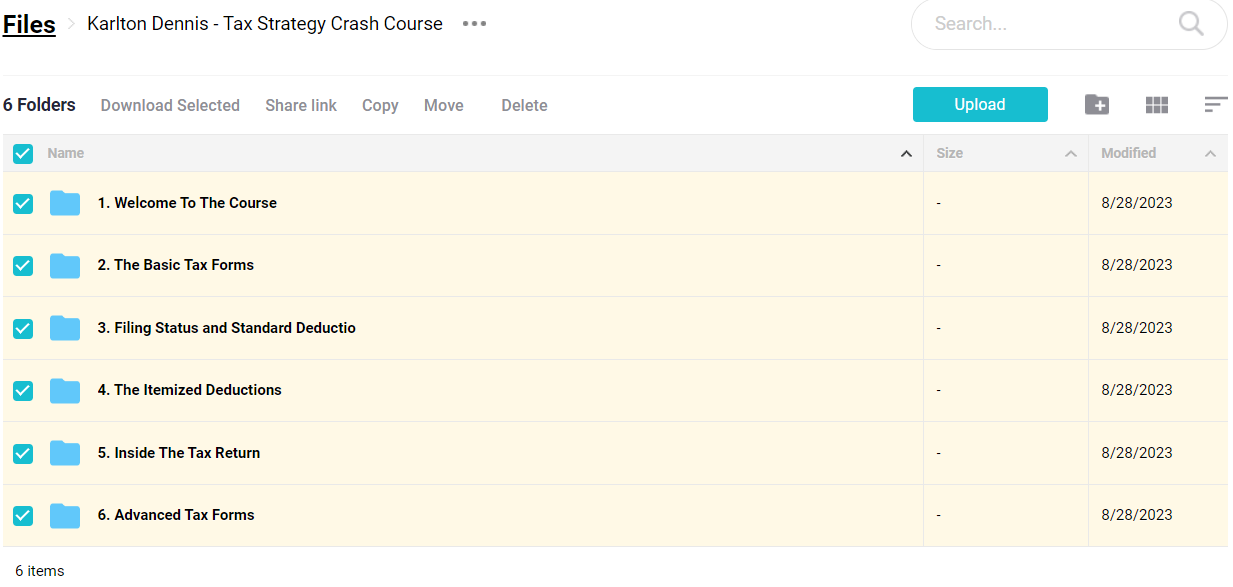

PROOF OF COURSE (217 MB)

What you’ll get in Tax Strategy Crash Course:

Learn how to read “Inside of the Return”

Learn how deductions impact you as a W-2 employee and as a 1099 employee.

Basic and Advance Tax Form Training

Business Owner Strategies and Tax Form Considerations

Join our Community of Tax Savers on our Discord Channel!

Why Choose Tax Strategy Crash Course?

Choosing the Tax Strategy Crash Course by Karlton Dennis is a good idea because it helps you understand and manage your taxes better. This course teaches you from the basics to more advanced tax-saving strategies, making it useful whether you’re new to taxes or have some experience. You’ll learn through practical examples which help you apply what you learn right away. The course also offers support through online forums and group coaching, which can help you along the way.

Who Is The Karlton Dennis – Tax Strategy Crash Course For?

The Karlton Dennis Tax Strategy Crash Course is designed for business owners, freelancers, and anyone interested in learning about tax strategies. It’s suitable for both beginners and those with more experience in handling taxes. The course teaches practical ways to reduce tax payments legally and helps understand complex tax rules. This can be a great resource if you want to improve your financial planning and save on taxes.

What is it included in Tax Strategy Crash Course?

Welcome To The Course

The Basic Tax Forms

Filing Status and Standard Deductions

The Itemized Deductions

Inside The Tax Return

Advanced Tax Forms

Who Is Karlton Dennis?

Karlton Dennis transitioned from a fitness enthusiast to a serial entrepreneur and a top-performing tax advisor, helping thousands of clients achieve their financial dreams. After earning his degree in Kinesiology from Cal Poly San Luis Obispo, Karlton embarked on his entrepreneurial journey by launching a fitness brand while managing a sales job. His relentless pursuit of financial success led him to discover that the key to building personal wealth was empowering others to do the same.

Joining his mother’s firm, Karla Dennis and Associates Inc., Karlton combined his business acumen, sales expertise, and in-depth tax knowledge to transform the family-owned business. Today, he stands as an industry MVP, renowned for saving clients over eight figures in taxes and delivering sold-out keynote speeches and top-ranked courses.

FAQs

The course is designed to equip individuals and business owners with essential tax strategies to effectively manage and minimize their tax liabilities. It covers a range of topics from basic tax principles to advanced planning techniques.

Karlton Dennis is a seasoned tax strategist with extensive experience in helping clients navigate complex tax laws. He brings practical insights and real-world examples to the course, ensuring participants gain actionable knowledge.

This course is ideal for small business owners, entrepreneurs, accountants, financial planners, and anyone interested in enhancing their understanding of tax strategies to optimize their financial planning.

The course covers various topics including tax planning fundamentals, deductions and credits, business structures and their tax implications, investment strategies for tax efficiency, and updates on the latest tax laws and regulations.

What My Clients Say – Real Reviews from Real People

“Game Changer”

Karlton has changed the way I see taxes…If you want to reduce your taxes legally, he shows you how to do it. Anyone can do this. – Charlie Chang Entrepreneur, Personal Finance Youtuber

“Would’ve paid double!”

I would have paid double, immediately, just to speak with Karlton. But once I did speak with him, even if I had paid double, I literally made my money back in twenty minutes. – Hunter Ceroy, Founder & CEO of ChiroQueens

“Saved Me Money”

I was able to leverage Karlton’s advice to now own twenty rental properties and offset hundreds of thousands of dollars of my income – Chad Wesley Smith, CEO of Juggernaut Training Systems

Conclusion

Join Karlton Dennis in the Tax Strategy Crash Course to empower yourself with the knowledge to manage and optimize your taxes. With practical advice, expert insights, and a supportive community, you’re set to make informed decisions that propel your financial success. Unlock the secrets to efficient tax management and start your journey towards financial mastery today.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet