Eric Cheung – Wall Street Prep – Equities Markets Certification (EMC©)

$299.00 Original price was: $299.00.$65.00Current price is: $65.00.

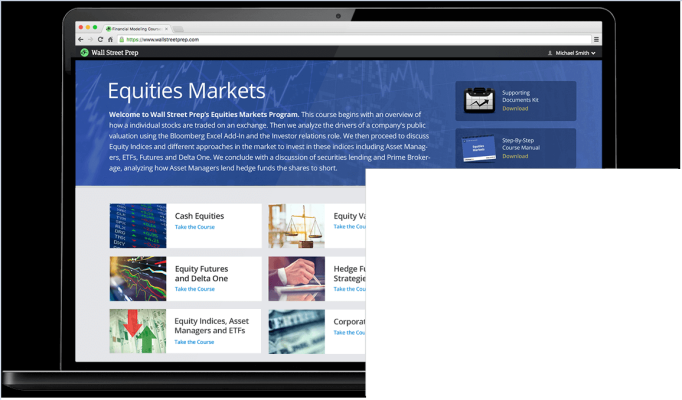

What Is Eric Cheung – Wall Street Prep – Equities Markets Certification (EMC©)? The Equities Markets Certification (EMC©) by Eric Cheung is a thorough training program for those looking to work in equities trading and sales. The course, created by former professionals, is built around what beginners and those new to the field need to know to start their careers.

Unlock the World of Equities Markets with EMC© Certification Program by Wall Street Prep

Introduction to Equities Markets Certification (EMC©) Program

Gain an edge in the competitive world of finance with the Equities Markets Certification (EMC©) crafted by Eric Cheung through Wall Street Prep. Unlike typical courses that focus on theory, this certification is grounded in real-world application, designed by industry experts who have honed their skills on the trading floors of major investment banks.

What Is Eric Cheung – Wall Street Prep – Equities Markets Certification (EMC©)?

The Equities Markets Certification (EMC©) by Eric Cheung is a thorough training program for those looking to work in equities trading and sales. The course, created by former professionals, is built around what beginners and those new to the field need to know to start their careers. It teaches important skills like using Bloomberg terminals to analyze stocks and understand financial markets deeply.

PROOF OF COURSE ( 1.80 GB)

Key Features of the EMC© Program

Expertly Designed Curriculum:

The EMC© curriculum is not just another academic course. It’s a bridge to the professional world, developed after thorough consultations with hiring managers from leading global banks. This program equips you with the practical insights needed to excel in growing markets like ETFs, Delta One, and Prime Brokerage.

What’ll You Learn From Equities Markets Certification?

Benefit from the wealth of experience shared by former sales and trading professionals who know exactly what it takes to succeed. This program offers invaluable insights into navigating the Bloomberg terminal, analyzing financial statements, and much more.

Comprehensive Learning Experience:

Wall Street Prep ensures a holistic learning journey, covering essential aspects of the equities market that salespeople and traders must master. From cash equities to hedge fund strategies, this certification covers it all.

Blockchain-Verified Certification:

Upon completion, participants receive a blockchain-verified certification, a testament to their expertise that can be proudly displayed on LinkedIn profiles and resumes, giving them a competitive edge in the job market.

Your Path to Becoming Certified:

Structured Learning Path:

The course is designed to mirror the demands of a career in equities markets. Starting with the basics of how stocks are traded, moving through the nuances of equity valuation, and diving deep into complex topics like securities lending and ESG investing, this certification covers the spectrum.

What Will You Master?

- The intricacies of trading and analyzing stocks, indices, and futures using Bloomberg.

- Equity market terminologies and trader jargon.

- Analyzing company financials with Bloomberg Excel-Add In.

- The economic drivers and priorities of Asset Managers and Hedge Funds.

- Identifying and leveraging arbitrage opportunities in ETFs.

- Understanding funded vs. unfunded investment options.

- Insights into derivatives trading, margining, and hedging.

- The mechanics of shorting a stock and securities lending processes.

- Exploring Hedge Fund Trading strategies.

Equities Markets Certification Curriculum:

1 Cash Equities

Cash Equities are the fundamental building blocks of the Equity Markets. We begin with an overview of the Equities trading floor and mapping out the different roles and responsibilities. We then take a look at exchange trading, and discuss the different order types, trading conventions and the opening and closing auctions. Next we dive into the spe …

2 Equity Valuation

Designed for Salespeople and Traders, this course provides an overview of equity valuation including the P/E ratio and EV/EBTIDA. We begin with an overview of valuation metrics and drivers of the income statement. We the discuss EPS and how we arrive at consensus EPS. After discussing the concepts, we see how salespeople, traders and investors use …

3 Equity Indices, Asset Managers and ETFs

Equity Indices such as the S&P500 drive market sentiment. We begin by discussing the major equity indices and then dive into the detail of how they are constructed and calculated. Next, we explore Asset Managers and explore how they invest funds for both institutional and retail investors. We discuss different strategies, including active versu …

4 Equity Futures and Delta One

Most traders start their day by looking at Equity Futures. This course builds on the Equity Indices, Asset Managers and ETFs course which looked at funded investments. The Equity Futures and Delta One course focuses on derivatives and achieving the same exposure using unfunded investments. We begin with an overview of futures and discuss details of …

5 Hedge Fund Strategies

This course demystifies Hedge Fund Strategies and how Hedge Fund Investors evaluate Hedge Funds. We begin by discussion traditional equity hedge funds and then discussing the strategies of growing quantitative hedge funds. Next, we discuss Macro, Relative Value and Credit Hedge funds, with many of these hedge funds using leverage to magnify returns …

6 Securities Lending and Prime Brokerage

How do you short a stock? In this course, we discuss the process to short a stock and walk through an example of how a hedge fund would borrow shares an asset manager through a securities lender. We discuss the fee model and economics of borrowing shares through a securities lender. Next, we analyze short interest metrics on Bloomberg including how …

7 ESG Investing, Green Bonds and Social Bonds

The last decade has seen exponential growth in ESG investing worldwide. Designed for those seeking to learn about the role of Sustainable Finance at an Investment Bank, this course explores exactly how this transformation happened and how the market formalized the structure and conventions for Green Bonds and Social Bonds. It discusses both from th …

Get the Equities Markets Certification

Trainees are eligible to take the WSP Equities Markets Certification Exam for 24 months from the date of enrollment. Those who complete the exam and score above 70% will receive a the certification. The exam is a challenging online assessment that covers the most difficult concepts taught in the program.

Who Should Enroll:

Whether you’re an intern, a new hire, or an early career analyst aspiring to carve a niche in the equities market, this program is tailored for you. It’s also ideal for professionals looking to update their skills or make a career switch into equities trading.

FAQs:

Eric Cheung is a distinguished figure in the finance industry, known for his expertise in equities markets and his role in developing the EMC© program at Wall Street Prep.

Unlike other courses that focus heavily on theoretical knowledge, the EMC© program is designed based on the real-world requirements of the equities market, offering practical skills and insights that are immediately applicable.

The EMC© certification is blockchain-verified, allowing you to easily share and showcase your achievement on LinkedIn and your resume, standing out to potential employers.

Who Is Eric Cheung?

Eric Cheung

Eric is the lead instructor for Wall Street Prep’s Capital Markets and Sales & Trading programs. Eric’s financial markets career began after he was a finalist for J.P. Morgan’s Fantasy Futures trading competition. Eric worked at J.P. Morgan for 10 years across DCM, Syndicate and Sales & Trading Roles, including in the Cross Asset Sales & Structuring group with trade execution experience across all asset classes. Eric is an expert in International Markets and Cross-Border transactions with global work experience in New York, London, Hong Kong and Tokyo.

BINGCOURSE – The Best Online Courses and Learning Website

✅ Our files are hosted on PCloud, Mega.Nz, and Google Drive.

✅ We provide a download link that includes the full courses as described. Do NOT include any access to Groups or Websites!

? More Courses: Forex Trading

Q & A

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet