Carter Cofield – Tax-Free Living Course – Your Blueprint to Tax Free Living

$1,497.00 Original price was: $1,497.00.$199.00Current price is: $199.00.

Download Tax-Free Living Blueprint: Carter Cofield’s Comprehensive Tax Planning Course (2.11 GB). Achieve financial freedom with Carter Cofield’s Tax-Free Living Course. Discover strategies to minimize taxes and secure a tax-free lifestyle. Enroll today!

Tax-Free Living Blueprint: Carter Cofield’s Comprehensive Tax Planning Course

Tax-Free Living Course – Your Blueprint to Tax Free Living By Carter Cofield

Unlock the Secrets to Tax-Free Living with Carter Cofield’s comprehensive Tax-Free Living Course. This expertly designed blueprint guides you step-by-step to achieve a lifestyle where you can legally minimize and eliminate your tax liabilities. Whether you’re an employee, entrepreneur, or investor, this course equips you with the knowledge and strategies to transform your financial future.

What Is Carter Cofield – Tax-Free Living Course – Your Blueprint to Tax Free Living?

The Carter Cofield Tax-Free Living Course, Your Blueprint to Tax Free Living is designed to teach you how to legally maximize tax savings. The course covers a wide range of topics aimed at transforming personal expenses into legitimate business deductions, thus promoting a tax-efficient lifestyle. It provides actionable strategies for business owners and individuals to leverage tax deductions and optimize tax savings.

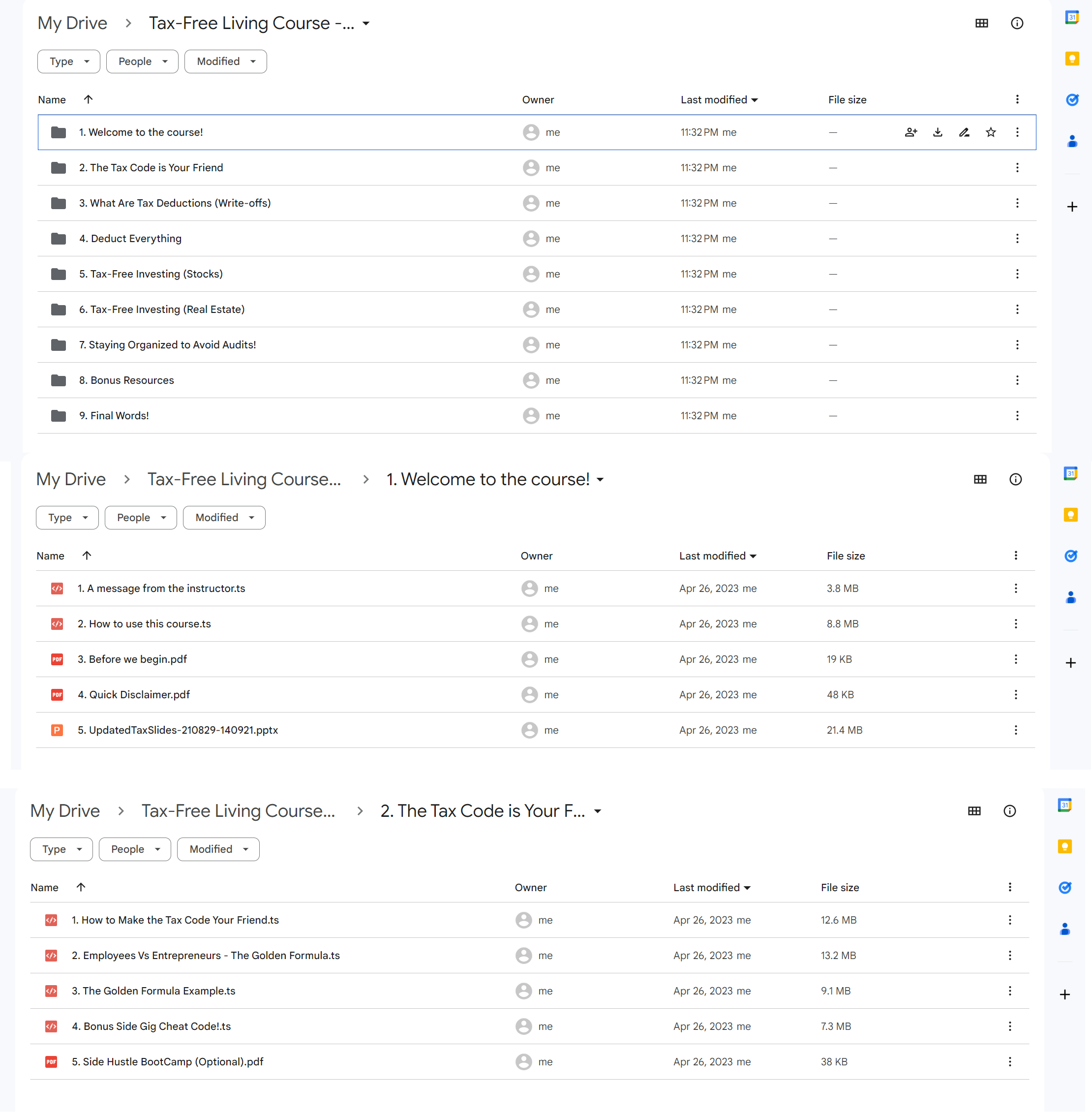

PROOF OF COURSE (2.11 GB)

What You’ll Learn From Tax-Free Living Course?

- How to convert personal spending into business deductions.

- Strategies for building generational wealth by efficiently managing taxes on funds given to children.

- Techniques for making the most of over two hundred tax deductions.

- The course also dives into investment strategies that remain tax-efficient, like investing in real estate and stocks using methods that minimize tax liability.

The course is structured to be accessible with easy-to-understand segments, making complex tax laws understandable for everyone from beginners to more experienced learners looking to optimize their tax situations. It includes practical steps and downloadable resources to help implement the strategies taught.

Course curriculum:

1 Welcome to the course!

- A message from the instructor

- How to use this course

- Before we begin…

- Quick Disclaimer (please read)

- Deduct Everything Powerpoint Slides

2 The Tax Code is Your Friend

- How to Make the Tax Code Your Friend

- Employees Vs. Entrepreneurs – The Golden Formula

- The Golden Formula Example

- Bonus: Side Gig Cheat Code!

- Side Hustle BootCamp (Optional)

3 What Are Tax Deductions (Write-offs)

- Understanding The Basics – What are Tax Deductions

- What Expenses Are Tax Deductible?

- Common Deduction Every Entrepreneur Must Know

4 Deduct Everything – Making Your Lifestyle Tax Deductible

- Turning Personal Expenses Into Business Deductions

- 10 Personal Expenses that Are Business Deductible

- Ultimate Tax Deduction Calculator Walkthrough

- Tax-Free Traveling & Shopping!

- Side Gig Cheat Code Pt.2

- How to Write-off a G-Wagon & Tesla!

- Paying Your Children Tax-Free!

- How to Write-Off Cartier Frames!

- Tax-Free Living E-Book! 200+ Tax Deductions!!

- Finding Business Use For Every Toy You Own!

5 Tax-Free Investing (Stocks)

- Long Terms Vs. Short Term Capital Gains

- Tax Loss Harvesting

- Tax Advantaged Investment Accounts

- Self-Employed Retirement Accounts

- Investing in Cryptocurrency Tax-Free (Self Directed IRA)

- Taxes For Traders

- Taxes for Traders Cheat Sheet!

6 Tax-Free Investing (Real Estate)

- Earn in Pocket – Lose on Paper

- 1031 Like-Kind Exchange

7 Staying Organized to Avoid Audits!

- Getting Organized & Record Keeping

- Bookkeeping Masterclass (Full Quickbooks Walkthrough)

- IRS Red Flags – 10 Tips to Avoid Audits

8 Bonus Resources

- Copy of Join Our Tax-Free Living Facebook Community!

- Monthly Mentorship Calls

- Bonus Resources

- Tax Saving Webinars, Workshops, & Interviews

- TAX-FREE LIVING E-BOOK! 200+ DEDUCTIONS

9 Final Words!

- Final Words

- Help Us Help You!

Who Is Carter Cofield?

Carter Cofield is a renowned tax strategist and mentor dedicated to helping individuals achieve financial independence through intelligent tax planning. With years of experience in navigating complex tax codes, Carter has empowered countless clients to save significant amounts on their taxes legally. His practical, easy-to-follow approach ensures that you can implement these strategies effectively, regardless of your current financial situation.

Why Choose the Tax-Free Living Course?

- Expert Instruction: Learn directly from a seasoned tax professional with proven success.

- Comprehensive Content: Covering everything from basic tax deductions to advanced investment strategies.

- Practical Application: Implement real-world strategies to achieve substantial tax savings.

- Community Support: Join a supportive network of fellow learners and tax savers.

- Flexible Learning: Access the course materials at your own pace, anytime, anywhere.

Client Testimonials

“Life-Changing Strategies”

“Carter’s Tax-Free Living Course transformed my approach to taxes. I’ve saved over $50,000 in just one year!”

— Jane Doe, Entrepreneur

“Highly Recommend”

“The practical tips and comprehensive content made it easy to implement tax-saving strategies. Truly a game-changer.”

— John Smith, Freelancer

“Achieved Financial Freedom”

“Thanks to Carter’s guidance, I can now live a tax-free lifestyle and focus on growing my business without the tax burden.”

— Emily Johnson, Small Business Owner

Conclusion

Embark on your journey to Tax-Free Living with Carter Cofield’s expertly crafted course. This comprehensive blueprint provides you with the knowledge and tools to legally minimize your tax liabilities, transform personal expenses into business deductions, and build generational wealth. Whether you’re an employee, entrepreneur, or investor, the Tax-Free Living Course offers actionable strategies to save between $20,000 and $100,000 on taxes annually. Enroll today and take the first step towards a financially free and tax-efficient lifestyle!

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet