Breaking Into Wall Street – Master Financial Modeling for Investment Banking

$397.00 Original price was: $397.00.$111.00Current price is: $111.00.

Master Financial Modeling for Investment Banking is a highly specialized skill essential for analyzing a company’s financial performance, valuing assets, and making informed investment decisions. It involves creating detailed mathematical representations of a company’s financial health, which are used to predict future financial outcomes and assess the impact of different financial scenarios.

Master Financial Modeling for Investment Banking with Breaking Into Wall Street

Unlock Your Potential in Investment Banking

Are you aspiring to excel in investment banking, private equity, or hedge funds? The Breaking Into Wall Street Financial Modeling Mastery Course is your gateway to mastering accounting, valuation, and financial modeling. Renowned as the “Deal Experience in a Box,” this course provides unparalleled training that closely mirrors real-world financial scenarios, giving you the competitive edge needed to dominate your investment banking interviews and thrive in your career.

What Is Breaking Into Wall Street – Master Financial Modeling for Investment Banking?

Master Financial Modeling for Investment Banking is a highly specialized skill essential for analyzing a company’s financial performance, valuing assets, and making informed investment decisions. It involves creating detailed mathematical representations of a company’s financial health, which are used to predict future financial outcomes and assess the impact of different financial scenarios. The process is rooted deeply in Excel, leveraging its robust functionalities to manipulate financial data and project future performance.

PROOF OF COURSE (23.0 GB)

Why Choose Breaking Into Wall Street’s Financial Modeling Mastery Course?

No other financial modeling or investment banking course offers the same depth of conceptual and practical expertise at any price point. Our course stands out by providing:

- Real-World Case Studies: Gain over 10 comprehensive, real-life case studies from investment banking, private equity, and hedge funds globally.

- Extensive Video Tutorials: Access dozens of engaging video tutorials that simplify complex financial concepts.

- Practical Exercises: Enhance your skills with 15+ in-depth, hands-on case studies and practice exercises.

- Global Perspective: Learn through case studies involving companies from North America, Europe, Asia, and Australia.

Comprehensive Course Features and Benefits

To ensure you stay ahead in today’s competitive market, our Financial Modeling Mastery Course includes:

- Dozens of Video Tutorials: Engaging and easy-to-follow videos that cover all essential topics.

- Detailed Lesson Notes and Transcripts: Enhance your learning with comprehensive notes and word-for-word transcripts.

- In-Depth Case Studies: Tackle practical scenarios that mirror real-life financial challenges.

- Progress Tracking and Note-Taking: Easily monitor your progress and take notes to reinforce your knowledge.

- Flexible Learning: Create personalized playlists to focus on key lessons and review materials as needed.

Comprehensive Case Studies for Global Financial Modeling

Our course offers a diverse range of global case studies, ensuring you develop a truly international perspective. Analyze real companies such as:

- Toro (U.S.)

- Atlassian (Australia)

- EasyJet (U.K.)

- Vivendi (France)

- Steel Dynamics (U.S.)

- Jazz Pharmaceuticals (U.S.)

- Builders FirstSource / BMC Stock Holdings (U.S.)

- SunPower / Maxeon (U.S. and Singapore)

- Fortum / Uniper (Finland and Germany)

- Kakao / Daum (Korea)

- Netflix (U.S.)

Each case study involves building detailed financial models, making investment recommendations, and answering comprehensive questions to simulate real-life financial decision-making.

Master Financial Modeling for Investment Banking – BREAKING INTO WALL STREET, what is it included:

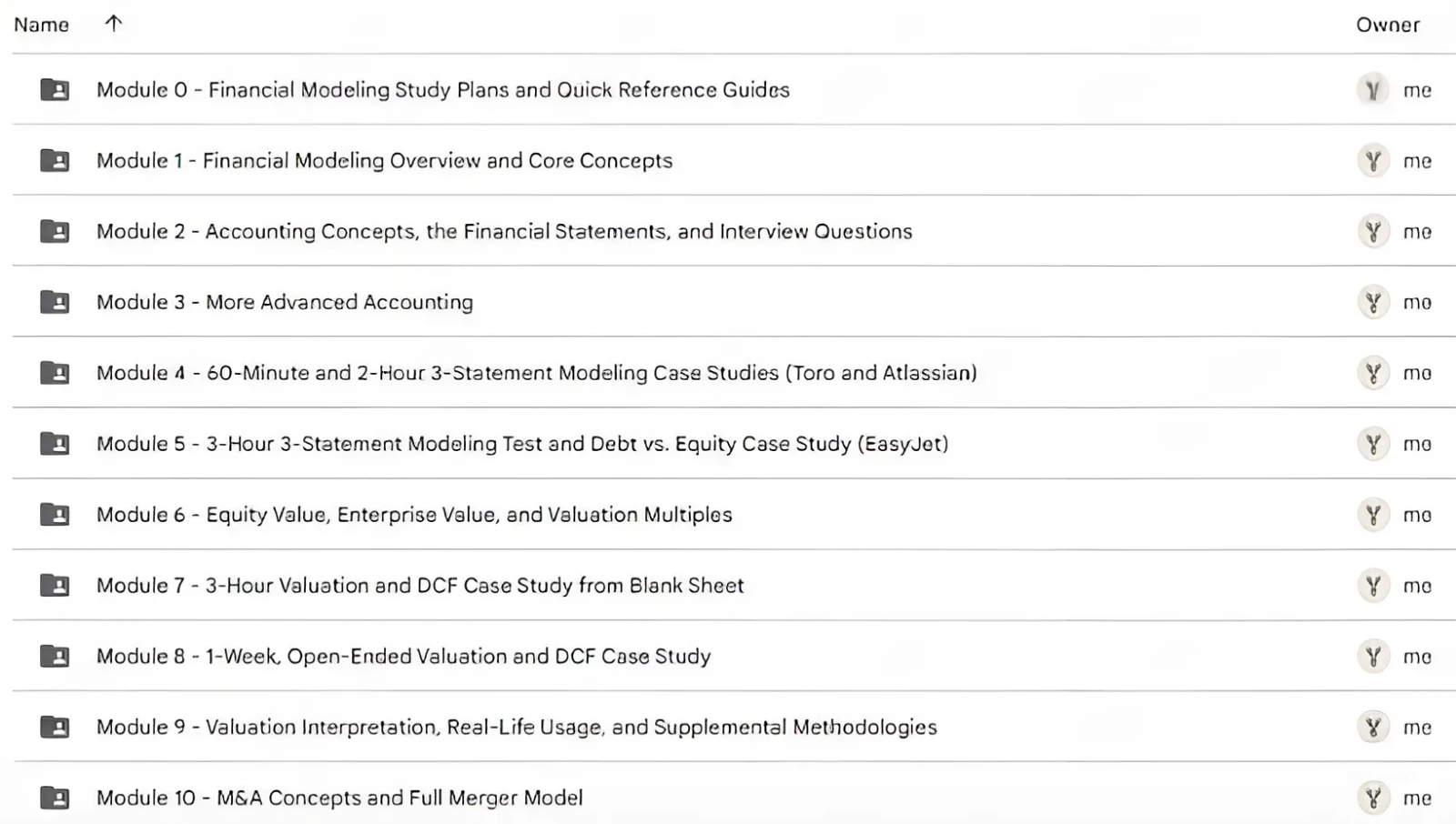

- Module 0 – Financial Modeling Study Plans and Quick Reference Guides

- Module 1 – Financial Modeling Overview and Core Concepts

- Module 2 – Accounting Concepts, the Financial Statements, and Interview Questions

- Module 3 – More Advanced Accounting

- Module 4 – 60-Minute and 2-Hour 3-Statement Modeling Case Studies (Toro and Atlassian)

- Module 5 – 3-Hour 3-Statement Modeling Test and Debt vs. Equity Case Study (EasyJet)

- Module 6 – Equity Value, Enterprise Value, and Valuation Multiples

- Module 7 – 3-Hour Valuation and DCF Case Study from Blank Sheet

- Module 8 – 1-Week, Open-Ended Valuation and DCF Case Study

- Module 9 – Valuation Interpretation, Real-Life Usage, and Supplemental Methodologies

- Module 10 – M&A Concepts and Full Merger Model

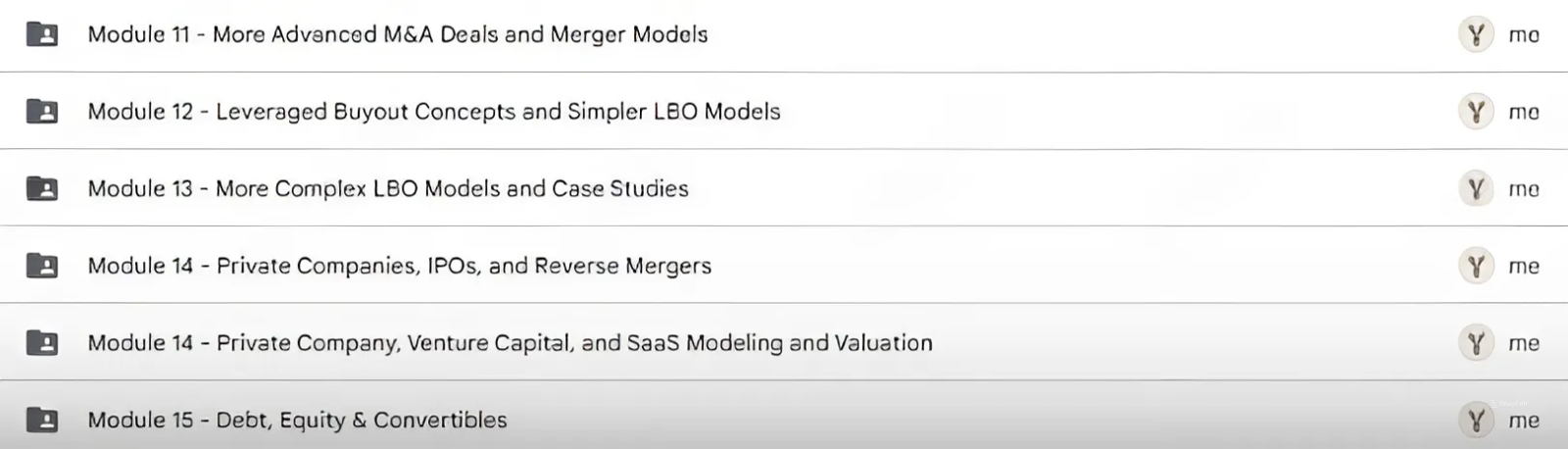

- Module 11 – More Advanced M&A Deals and Merger Models

- Module 12 – Leveraged Buyout Concepts and Simpler LBO Models

- Module 13 – More Complex LBO Models and Case Studies

- Module 14 – Private Companies, IPOs, and Reverse Mergers

- Module 14 – Private Company, Venture Capital, and SaaS Modeling and Valuation

- Module 15 – Debt, Equity & Convertibles

- Module 16 – Certification Quiz

In-Depth Learning Modules

Our structured modules guide you through every aspect of financial modeling and investment banking:

Module 1: Modeling Overview and Core Concepts

In this introductory module, you’ll learn what “financial modeling” means, how you use it in real life, and the core concepts required to understand the rest of this course, including the time value of money, Present Value and Net Present Value, the Discount Rate, and the Internal Rate of Return (IRR).

Module 2: Accounting Concepts, the Financial Statements, and Interview Questions

We’ll explore accounting from a business perspective, and we’ll drill down using examples of our online business to teach you how and why the financial statements work the way they do. You’ll also learn how to answer common interview questions, including both single-step and multi-step scenarios, and how more advanced items, such as Operating Leases, Net Operating Losses, and Deferred Taxes, work.

Module 3: More Advanced Accounting

You’ll learn about the Book Value, Face Value, and Market Value of Debt here, as well as Issuance Fees and Original Issue Discount (OID); other topics include Equity Investments and Noncontrolling Interests, the tax treatment of Stock-Based Compensation, Unrealized Gains and Losses, FIFO vs. LIFO for Inventory, and Pension Accounting for defined-benefit pension plans.

Module 4: Projecting the 3 Statements (Toro and Atlassian)

In this module, you’ll complete 60-minute and 2-hour case studies based on 3-statement projection models for Toro, a landscape maintenance equipment company, and Atlassian, a subscription-based enterprise software company, and you’ll make investment recommendations based on the output of both exercises.

Module 5: More Advanced 3-Statement Projections (EasyJet)

In this module, you’ll complete a 3-hour 3-statement modeling test for EasyJet, a low-cost carrier based in the U.K., with routes all over Europe. You will then use the output of this model to advise the company on its proper mix of Debt and Equity. You will build revenue and expense projections based on drivers such as ASKs, Load Factors, and Passenger Yields, and you’ll add a Debt & Equity Schedule to the model to support the company’s financing needs.

Module 6: Equity Value, Enterprise Value, and Multiples (Target, Vivendi, and Zendesk)

In this module, you’ll learn how to calculate Equity Value, Enterprise Value, and Valuation Multiples for companies that follow U.S. GAAP and IFRS, as well as the core concepts everything – including how items like Equity Investments, Noncontrolling Interests, Pensions, Leases, and Net Operating Losses factor into the calculations.

Module 7: Valuation and DCF Case Study (Steel Dynamics)

In this module, you’ll complete a 2-hour valuation and DCF case study based on Steel Dynamics, a leading steel manufacturing company in the U.S., and you’ll learn how to project Free Cash Flow, calculate the Discount Rate, estimate Terminal Value, and use Public Comps and Precedent Transactions.

Module 8: More Advanced Valuation and DCF Case Study (Jazz Pharmaceuticals)

In this module, you’ll complete a 1-week “take home” valuation and DCF case study based on Jazz Pharmaceuticals, a specialty pharmaceutical company based in the U.S. that develops orphan drugs. You’ll project revenue for its existing and pipeline drugs, add stub periods and the mid-year convention to the DCF, and complete Public Comps and Precedent Transactions using corporate filings.

Module 9: Valuation Interpretation and Real-Life Usage (Jazz Pharmaceuticals)

In this module, you’ll learn how to apply and interpret a valuation in real life by creating a short stock pitch (for hedge fund and asset management roles), equity research report, and investment banking pitch book for Jazz Pharmaceuticals based on the valuation and DCF analysis from the previous module.

Module 10: M&A Concepts and Full Merger Model (Builders FirstSource and BMC Stock Holdings)

In this case study, you’ll analyze Builders FirstSource’s $2.5 billion acquisition of BMC Stock Holdings and complete both 60-minute and 3-hour versions of the model. You’ll also learn about fundamental M&A concepts in the first few lessons, such as deal types, payment methods, public vs. private company assumptions, and Equity Value and Enterprise Value in M&A. The last few lessons of the more advanced case study cover M&A valuation, contribution analysis, and value creation analysis.

Module 11: More Advanced Merger Models (Multiple Case Studies)

You’ll complete a more advanced version of the Builders FirstSource / BMC model here, including quarterly projections and stock vs. asset vs. 338(h)(10) treatment, and you’ll complete additional case studies on SunPower’s spinoff of Maxeon and a Sum-of-the-Parts valuation for the deal and Fortum’s acquisition of a majority stake in Uniper (including variable close dates and stub-period financial statements). Each case study includes a presentation or questions and answers at the end.

Module 12: Leveraged Buyouts and LBO Models (Multiple Case Studies)

You’ll complete multiple case studies in this module, ranging from a simple LBO model to a paper LBO model to 60-minute, 90-minute, and 3-hour modeling tests based on a variety of companies and deals (including a private company in Germany, Bain’s leveraged buyout of nursing-home operator NichiiGakkan in Japan, and Apollo’s buyout of the Great Canadian Gaming Corporation). You’ll learn how to build models quickly and efficiently, answer case study questions, and complete modeling tests starting from scratch and starting from templates.

Module 13: More Advanced LBO Models

You will build a more advanced LBO model based on KKR’s buyout of Viridor (divestiture from Pennon Group) in the U.K., with features such as stub periods, a dividend recap, and management earn-outs; you’ll also make investment recommendations to both the equity investors and the lenders. The second case study is an open-ended “take home” one based on Cars.com, in which you complete industry research, build your own model, and make an investment recommendation at the end.

Module 14: Private Companies, IPOs, and Reverse Mergers (Kakao / Daum)

In this case study, you will learn all about private company valuation and financial modeling via Kakao’s reverse merger with Daum Communications (two Internet/mobile companies in South Korea). You’ll learn how to make adjustments for private companies, how to model an initial public offering (IPO), and how to advise the company on a reverse merger vs. traditional M&A deal vs. IPO.

Module 15: Debt, Equity & Convertibles (Netflix)

In this case study, you’ll advise Netflix on the best way to secure the $1.5 billion it needs to fund its international expansion efforts. You’ll build a 3-statement model for the company with multiple scenarios, analyze its credit stats and ratios and covenants, and analyze bond yields, duration, convexity, call and put options, make-whole calls, refinancing options, and more. You’ll also value a possible convertible bond, analyze its payoff profile and dilution, create a follow-on equity proceeds analysis, and draft a credit memo and longer advisory presentation for the company.

Practical Skills for Investment Banking Success

By completing our Financial Modeling Mastery Course, you will:

- Dominate Interviews: Prepare thoroughly for investment banking interviews with comprehensive practice exercises and case study questions.

- Build Robust Financial Models: Develop proficiency in creating 3-statement models, DCF analyses, merger models, and LBO models.

- Gain Virtual Deal Experience: Simulate real-world financial transactions and investment scenarios to enhance your practical expertise.

- Achieve Deep Conceptual Understanding: Grasp advanced financial concepts that top bankers seek but rarely find in other courses.

- Outperform Peers on the Job: Utilize financial modeling skills to excel in your role and advance rapidly within your organization.

Student Success Stories

Join over 48,569 students who have successfully mastered financial modeling and secured high-paying jobs in top investment banks, private equity firms, hedge funds, and more. Hear from our satisfied customers:

“Great news, I just got a full-time offer in IB J.P. Morgan in London!! Your courses have been absolutely key in achieving this.”

Conclusion

The Breaking Into Wall Street Financial Modeling Mastery Course is your ultimate resource for mastering financial modeling and securing a successful career in investment banking. With comprehensive modules, real-life case studies, and extensive practical exercises, you’ll gain the skills and confidence needed to stand out in competitive interviews and excel in your professional role. Enroll today to take the first step towards dominating the financial industry and achieving your career goals.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet