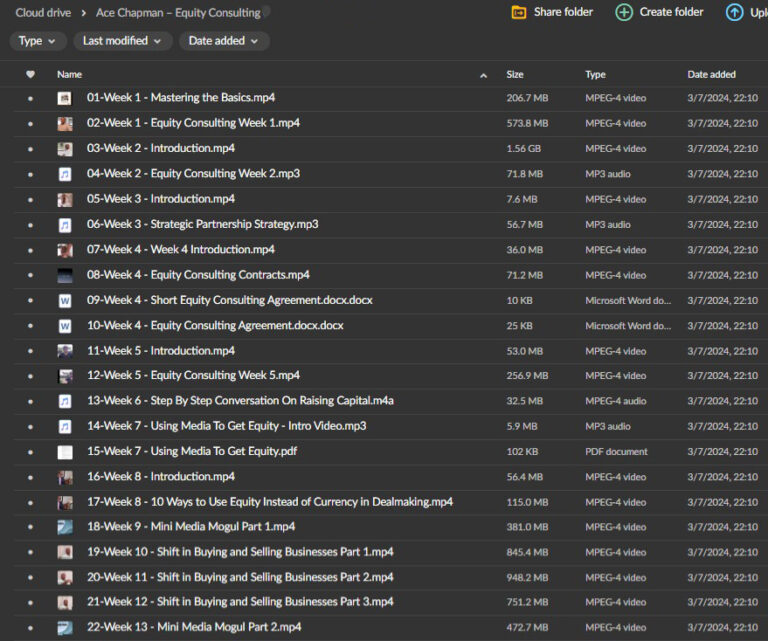

Ace Chapman – Equity Consulting

$997.00 Original price was: $997.00.$21.00Current price is: $21.00.

Ace Chapman – Equity Consulting: Comprehensive Guide to Mastering Equity Transactions

What Is Ace Chapman – Equity Consulting?

Ace Chapman – Equity Consulting is a comprehensive educational program designed for professionals and aspiring entrepreneurs interested in mastering the art and science of equity consulting. Founded by Ace Chapman, who brings over two decades of hands-on experience in buying, selling, and growing businesses, this program provides participants with actionable strategies for sourcing, negotiating, and managing equity deals. Through structured modules and real-world case studies, the course equips students with practical knowledge to navigate the complexities of equity transactions and create sustainable business growth.

Why Choose Ace Chapman – Equity Consulting?

When looking for expert guidance in equity consulting, Ace Chapman’s program stands out for several compelling reasons:

Comprehensive Curriculum Based on Proven Experience

The Ace Chapman – Equity Consulting program offers an extensive curriculum covering all aspects of equity transactions. Drawing from Ace’s experience of acquiring over 100 businesses, the course delivers practical insights rather than theoretical concepts. Each module builds upon real-world successes and challenges, providing students with strategies that have been tested and refined in actual business scenarios.

Practical, Action-Oriented Approach

Unlike many business courses that focus primarily on theory, Ace Chapman – Equity Consulting emphasizes practical application through:

- Detailed case studies of successful equity deals

- Customizable templates for legal documents and negotiations

- Step-by-step frameworks for evaluating business opportunities

- Actionable strategies that can be implemented immediately

Expert Guidance from a Recognized Authority

Ace Chapman is widely recognized for his expertise in business acquisitions and equity consulting. His track record of successful transactions and business growth provides students with credible, reliable guidance based on:

- Two decades of active involvement in equity transactions

- Experience across diverse industries and business sizes

- A proven methodology for identifying undervalued businesses

- Strategic approaches to maximizing business value and returns

Personalized Learning Experience

The program is designed to accommodate students at various stages of their business journey:

- Beginners receive foundational knowledge to start confidently

- Intermediate practitioners gain strategies to refine their approach

- Advanced entrepreneurs learn sophisticated techniques for scaling operations

- All participants receive guidance tailored to their specific goals and experience level

Focus on Relationship Management

Recognizing that successful equity deals depend on more than financial analysis, the course places significant emphasis on:

- Building trust with business owners and stakeholders

- Managing psychological aspects of negotiations

- Developing long-term relationships for continued deal flow

- Navigating the human elements that often determine transaction success

What You’ll Learn in Ace Chapman – Equity Consulting

How to Source and Obtain Equity Through Consulting

Finding the right opportunities that align with your expertise is a critical first step. The program teaches you how to:

- Identify businesses that match your skill set and investment criteria

- Develop efficient systems for generating consistent deal flow

- Evaluate opportunities using quantitative and qualitative metrics

- Position yourself as a valuable consultant to gain equity in businesses

- Build networks that provide access to off-market opportunities

How to Negotiate and Secure Favorable Equity Positions

Once you’ve identified promising opportunities, you need to structure and secure the right deal. The course provides:

- Proven negotiation frameworks for equity transactions

- Legal templates customized for various deal structures

- Email scripts and communication strategies for different scenarios

- Due diligence checklists to avoid costly mistakes

- Techniques for overcoming common obstacles in negotiations

How to Drive Growth and Maximize Investment Returns

Securing equity is just the beginning—creating value is where the real work begins. Learn how to:

- Implement a structured 100-day plan after acquiring equity

- Develop targeted marketing strategies to accelerate growth

- Optimize operations for improved efficiency and profitability

- Scale businesses through strategic expansions and acquisitions

- Create systems that allow for effective management across multiple investments

PROOF OF COURSE (6.39 GB)

The Complete Equity Consulting Process

1. Identifying Strategic Opportunities

The foundation of successful equity consulting begins with identifying the right opportunities:

- Comprehensive self-assessment to leverage your existing skills and knowledge

- Criteria development for target opportunity selection (size, industry, location, etc.)

- Legal entity establishment and structuring for optimal protection and tax benefits

- Creation of your unique value proposition as an equity consultant

2. Sophisticated Sourcing and Evaluation

Building a robust pipeline of potential deals requires systematic approaches:

- Multi-channel sourcing strategies for consistent deal flow

- Advanced financial analysis techniques for accurate business valuation

- Industry-specific evaluation frameworks to identify growth potential

- Assessment methodologies for management teams and operational efficiency

- Risk evaluation processes to identify and mitigate potential challenges

3. Expert Negotiation and Thorough Due Diligence

Successful equity consulting requires mastery of negotiation and verification:

- Analysis of case studies showcasing successful negotiation strategies

- Advanced negotiation tactics tailored to different seller motivations

- Comprehensive due diligence checklists by functional area

- Legal templates for various transaction structures

- Strategies for addressing issues discovered during due diligence

4. Strategic Financing and Transaction Completion

Learn sophisticated methods to structure and fund your equity acquisitions:

- Creative financing approaches beyond traditional lending

- Tax-efficient transaction structuring techniques

- Asset transfer methodologies that minimize risk and liability

- Investor management strategies for external capital sources

- Closing processes that ensure smooth ownership transitions

5. Sustainable Growth and Strategic Expansion

Maximize the value of your equity positions through systematic growth:

- Market analysis techniques to identify expansion opportunities

- Comprehensive go-to-market planning for new products or services

- Intellectual property protection and development strategies

- Capital allocation frameworks for reinvestment decisions

- Performance monitoring systems for continuous improvement

6. Value-Maximizing Exit Strategies

Plan for optimal exits that maximize your return on equity:

- Timing considerations for different market conditions

- Operational improvements to increase business valuation

- Strategic positioning to attract premium buyers

- Transaction structuring for tax-efficient exits

- Reinvestment strategies for compounding returns

Who Benefits from Ace Chapman – Equity Consulting?

The program is specifically designed to serve diverse professionals interested in equity transactions:

Aspiring Entrepreneurs

For those looking to build business portfolios through acquisitions rather than startups, the program provides:

- Frameworks for evaluating existing businesses with growth potential

- Strategies for acquiring businesses with minimal personal capital

- Methods for leveraging consulting expertise to gain equity positions

- Systems for managing multiple business interests efficiently

Strategic Investors

Individuals seeking to diversify beyond traditional investments will gain:

- Approaches for direct business investments with active involvement

- Techniques for identifying undervalued business opportunities

- Skills for adding tangible value to business investments

- Strategies for higher returns compared to passive investments

Business Consultants and Advisors

Professionals already in advisory roles can enhance their service offerings with:

- Additional expertise in equity transactions and business acquisitions

- Value-adding skills beyond traditional consulting

- Frameworks for transitioning from fee-based to equity-based compensation

- Methods for building long-term wealth through client equity positions

Newcomers to Business Acquisition

Those new to equity transactions will receive:

- Step-by-step guidance through the entire acquisition process

- Foundational knowledge in business valuation and deal structuring

- Risk mitigation strategies for first-time acquirers

- Mentorship on avoiding common pitfalls in equity transactions

Experienced Business Owners

Established entrepreneurs looking to expand through acquisitions will benefit from:

- Advanced strategies for horizontal and vertical integration

- Synergy identification between existing operations and new acquisitions

- Portfolio management techniques for multiple business interests

- Succession planning and legacy building through equity management

About Ace Chapman: Proven Expertise in Equity Transactions

Ace Chapman is a renowned entrepreneur and business acquisition specialist with a distinguished track record in buying, selling, and growing small to medium-sized businesses. His entrepreneurial journey began during his college years when he purchased his first business, demonstrating an early aptitude for identifying undervalued opportunities.

Over the past two decades, Ace has:

- Acquired and managed a portfolio of over 100 businesses across diverse industries

- Developed proprietary methodologies for business valuation and deal structuring

- Created systems for efficiently sourcing and evaluating acquisition targets

- Established networks providing access to off-market business opportunities

- Mentored numerous entrepreneurs in successful business acquisition strategies

Ace’s expertise extends beyond simple acquisitions to encompass the entire equity value chain—from identifying opportunities and securing favorable terms to implementing growth strategies and executing profitable exits. This comprehensive knowledge forms the foundation of the Equity Consulting program, providing students with insights gained from real-world experience rather than theoretical concepts.

Conclusion: Transform Your Business Journey with Ace Chapman – Equity Consulting

Ace Chapman – Equity Consulting represents a transformative opportunity for entrepreneurs, investors, and business professionals looking to master the art of equity transactions. Through comprehensive education, practical resources, and expert guidance, participants gain the skills and confidence needed to successfully navigate the complex world of business acquisitions and equity consulting.

By choosing this program, you’re not just learning theory—you’re gaining access to proven strategies developed through decades of successful transactions. Whether you’re looking to start your journey in business ownership, expand your existing portfolio, or transition from traditional consulting to equity-based arrangements, Ace Chapman – Equity Consulting provides the roadmap to achieve your goals.

The program’s emphasis on practical application, personalized learning, and relationship management ensures that participants develop not just the technical knowledge but also the soft skills essential for success in equity transactions. With Ace Chapman’s guidance, you can confidently pursue equity opportunities that align with your skills and goals, creating sustainable wealth through strategic business ownership.

Take the next step in your professional journey and discover how Ace Chapman – Equity Consulting can help you build a portfolio of successful businesses through expert equity consulting strategies.

Q & A

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet