Diamant Capital – Technical & Fundamental Courses

$500.00 Original price was: $500.00.$18.00Current price is: $18.00.

Diamant Capital – Technical & Fundamental Courses: Comprehensive Trading Education

Introduction to Diamant Capital’s Trading Education

Diamant Capital offers comprehensive Technical and Fundamental Trading Courses designed to transform novice traders into confident market participants. Founded by an experienced trader who transitioned from architecture to professional trading, Diamant Capital focuses on delivering practical, mechanical trading strategies that can be consistently applied in real market conditions. These courses stand out for their balanced approach to trading education, covering both technical analysis and fundamental market drivers.

Complete Technical and Fundamental Course Bundle Overview

The Diamant Capital trading education package includes two comprehensive components with a one-time payment structure:

- Complete Technical Trading Course – A 40-video Smart Money Concepts course (4 hours) that progresses from basic concepts to advanced trading techniques, culminating in practical trade entries and effective risk management strategies.

- Complete Fundamental Analysis Course – A 40-video comprehensive course (4 hours) exploring macroeconomic principles and their practical application to determine directional bias across any currency pair on a weekly basis.

What Is Diamant Capital – Technical & Fundamental Courses?

“Diamant Capital – Technical & Fundamental Courses” are comprehensive educational offerings designed to equip individuals with a robust understanding of both technical and fundamental aspects of trading and investing. These courses cater to a range of participants, from beginners seeking foundational knowledge to experienced traders aiming to refine their skills.

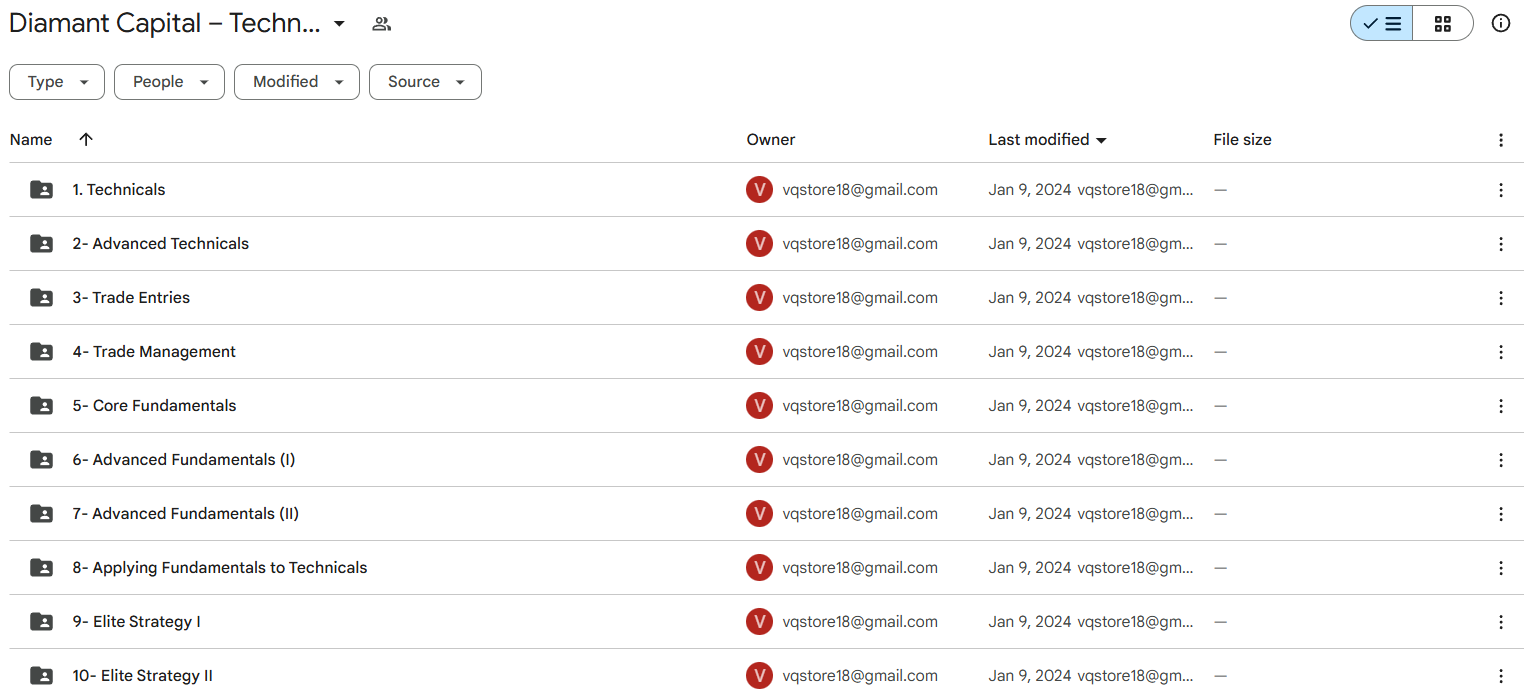

Course curriculum:

1 Technicals

1- Introduction

2- Market structure

3- Premium and discount

4- Institutional order flow

5- Order Block types

6- Liquidity

7- Voids & Imbalances

8- BOS & Liquidity grabs

9- Consolidations

10- Expansions

11- piecing everything together

2 Advanced Technicals

1- Time price weekly

2- Time and price daily

3- 3 Types of Volume Strategies

4- Divergences

5- Insitutional Swing Point

6- Market Cycles

7- Laws of wyckoff & volume divergence

8- Accumulation Schematic

9- Distribution Schematic

10- Re-accumulation and re-distribution schematics

11- Application of wyckoff

12- Improving win rate with wyckoff

3 Trade Entries

1- Risk vs confirmation trades

2- Invalidation

3- Currency correlation divergence

4- Currency volatility and data

5- Entry refinement

6- Inducements

7- Introduction to optimum trades

8- Optimum trade entry 1

9- Optimum trade entry 2

10- Optimum trade entry 3

4 Trade Management

1- Risk management plan

2- Taking profits

3- Increasing probability with confirmations

4- Deciding which pairs

5- Preparing for the week

6- Backtesting

7- Trading Live & Funded

8- Trading Plan

9- Intro to fundamentals

5 Core Fundamentals

1- Introduction

2- Economic train

3- GDP

4- Interest rates

5- Inflation & Deflation

6- Measures of Inflation

7- Asset class Introduction

8- Risk on vs risk off

9- Implications of Imports & Exports

10- Endogenous & Exogenous Differentials

6 Advanced Fundamentals (I)

1- Money supply

2- Economic Cycles

3- Monetary Policies

4- Fiscal Policies

5- Budget Deficits

6- Quantitative Easing

7- Reduction of Asset Purchases

8- Low interest rate market

9- High interest rate environement

7 Advanced Fundamentals (II)

1- Federal Funds Rate

2- FED Funds rate indicators

3- Types of interest rates and GDP

4- Bonds and yields

5- Yield Curves

6- Economic drivers

7- NFP & Employment

8 Applying Fundamentals to Technicals

1- Links to Key Websites

2- Bloomberg terminal

3- Trading news events

4- Confirmations;; institutional orders and volatility

5- Resources to learn

6- Asset class corrrelation stocks and bonds

7- Asset classes currency commoditites

8- Fundamental Divergences

9- Applying fundamentals to technicals

10- Final words

9 Elite Strategy Essentials I

1- Introduction

2- First 4 steps before any Trade

3- Weekly Routine

4- Daily Routine

5- Primary / Secondary structure

6- CHoCH / BOS: The key to confirmations

7- Choosing high quality POIs: 4 rules

8- Choosing POIs: extra confirmations

9- Missing Entries: What to do…

10- Reversal Areas: taking profits

10 Elite Strategy Essentials II

1- LTF Trading: Imbalances / order blocks

2- Order Flow Trading

3- Inducements: Always stopped out?

4- Importance of Market Flow

5- How the market moves between Zones

6- How I’ve changed as a Trader

7- Elite Strategy: Engulfed entries

8- Elite strategy: full fundamental guide

9- Elite strategy: putting everything together

PROOF OF COURSE (1.15 GB)

What You’ll Learn From Technical & Fundamental Courses

Technical Analysis Mastery

Students develop expertise in chart interpretation, pattern recognition, and technical indicator utilization including moving averages, RSI, and Fibonacci retracements. The course emphasizes candlestick analysis for effective price movement prediction.

Fundamental Analysis Proficiency

Participants gain deep insights into economic indicators, financial statement analysis, and central bank policy impacts. This knowledge provides the foundation for understanding macroeconomic factors driving market behavior.

Risk Management Expertise

The courses teach essential risk minimization strategies while maximizing return potential—a critical component of successful trading.

Practical Application Focus

Diamant Capital emphasizes real-world application through simulations and case studies, allowing students to apply theoretical concepts in controlled environments before risking capital in live markets.

Theory-Practice Integration

A distinguishing feature of these courses is their balanced approach combining theoretical knowledge with practical exercises, enhanced through interactive webinars and community discussions.

Why Choose Diamant Capital – Technical & Fundamental Courses?

Comprehensive Curriculum Design

The dual focus on technical and fundamental analysis provides a well-rounded trading education, enabling students to analyze markets from multiple perspectives for more informed decision-making.

Expert Instructor Guidance

Courses are led by experienced trading professionals with extensive market experience, translating complex concepts into accessible, practical trading approaches.

Practical Application Emphasis

A standout feature is the focus on real-world application through simulations, case studies, and hands-on exercises that bridge the gap between theory and actual trading.

Dynamic Learning Environment

The courses utilize multiple learning modalities including video lectures, reading materials, and interactive webinars, supplemented by community forums for peer discussion and networking.

Flexible Learning Structure

With self-paced options and lifetime updates, these courses accommodate varied schedules while ensuring students remain current with evolving market concepts.

Trading Community Access

Participation provides access to an active trading community, facilitating idea exchange and strategy discussions in a collaborative learning environment.

Who Is Diamant Capital?

Diamant Capital has established itself as a specialized trading education provider focused on integrating technical and fundamental market analysis. Founded by a trader who successfully transitioned from architecture to professional trading, the company emphasizes mechanical, repeatable trading strategies that can be consistently applied across market conditions.

Their educational philosophy centers on equipping traders with practical tools and strategies necessary for consistent profitability. Their comprehensive course offerings include video instruction and mentorship opportunities designed to accommodate traders at all experience levels.

Who Is The Technical & Fundamental For?

Beginner Traders

Newcomers benefit from a structured introduction to trading fundamentals, gaining essential skills in chart analysis and economic indicator interpretation while building confidence in market navigation.

Intermediate Market Participants

Those with some experience will appreciate the advanced modules covering sophisticated technical indicators, risk management frameworks, and macroeconomic factor analysis for strategy refinement.

Experienced Traders

Even seasoned professionals find value in the comprehensive approach, with advanced topics and practical applications offering opportunities to optimize existing strategies and explore new techniques.

Diverse Learning Preferences

The flexible course structure accommodates various learning styles through video lectures, reading materials, and interactive sessions, ensuring effective knowledge transfer regardless of preferred learning method.

CONCLUSION

Diamant Capital’s Technical & Fundamental Courses offer a uniquely comprehensive trading education that balances technical analysis with fundamental market understanding. This integrated approach provides traders with a complete toolkit for market analysis, trade execution, and risk management.

The curriculum’s progression from foundational concepts to advanced strategies ensures relevance for traders at all experience levels. By combining Smart Money Concepts with macroeconomic analysis, Diamant Capital provides students with a holistic market perspective that extends beyond typical trading courses.

For those seeking to develop or refine their trading approach, Diamant Capital’s Technical & Fundamental Courses represent a valuable educational investment that addresses both the analytical and practical aspects of successful trading. The emphasis on mechanical, repeatable strategies creates a framework for consistent performance across varying market conditions.

Q & A

Related products

Forex Trading

Forex Trading

Reviews

There are no reviews yet