Robert Prechter – Elliott Wave International – The Socionomic Theory of Finance

$39.00 Original price was: $39.00.$14.00Current price is: $14.00.

Download Discover the Socionomic Theory of Finance by Robert Prechter (1.50 GB). The Socionomic Theory of Finance, developed by Robert Prechter, offers a unique perspective on how social mood influences financial markets and broader societal trends. Unlike traditional theories that suggest economic events shape public sentiment, socionomics proposes that collective social mood drives financial and economic behaviors.

Discover the Socionomic Theory of Finance by Robert Prechter

An Alternative to the Efficient Market Hypothesis (EMH) and a Foundation for Technical Analysis

Unlock a transformative perspective on financial markets with Robert Prechter’s Socionomic Theory of Finance. Presented at the 2014 International Federation of Technical Analysts Conference in London, this comprehensive and concise presentation challenges traditional financial theories and offers innovative insights into market dynamics.

What Is Robert Prechter – Elliott Wave International – The Socionomic Theory of Finance?

The Socionomic Theory of Finance, developed by Robert Prechter, offers a unique perspective on how social mood influences financial markets and broader societal trends. Unlike traditional theories that suggest economic events shape public sentiment, socionomics proposes that collective social mood drives financial and economic behaviors.

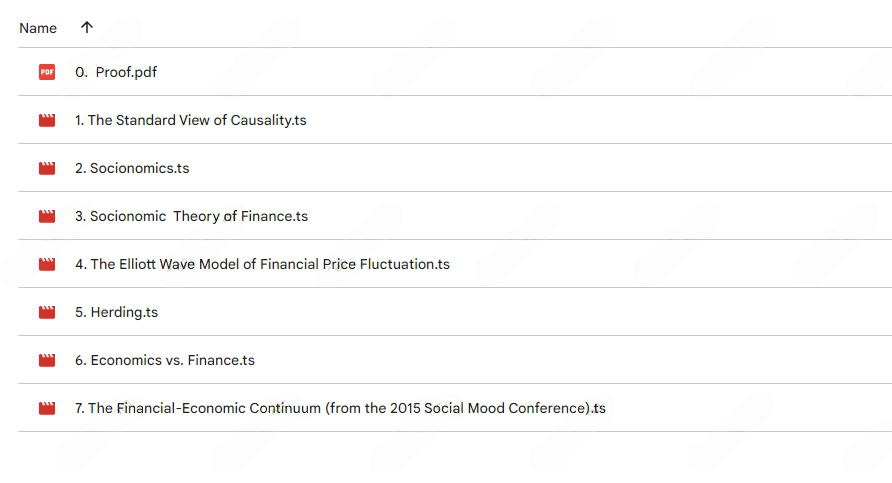

PROOF OF COURSE (1.50 GB)

About the Presentation

Format: Streaming | Duration: 53 minutes + 17-minute bonus feature

Presenter: Robert Prechter

Skill Level: Intermediate

In this engaging 53-minute session, Robert Prechter delves into socionomics, providing viewers with the tools to anticipate, understand, and act on emerging social trends that most investors overlook. By integrating this theory into your investment strategy, you can gain a competitive edge in the financial markets.

Key Learnings from the Presentation

- Innovative Cause and Effect in Finance: Learn a groundbreaking approach to understanding the relationships between social behavior and financial markets.

- Debunking Market Myths: Challenge and discard common misconceptions about how markets operate.

- Financial Wellbeing: Discover why adopting this new perspective is crucial for your financial health and overall wellbeing.

Understanding Socionomic Theory of Finance (STF)

Robert Prechter introduces Socionomic Theory of Finance (STF), a revolutionary framework that redefines social and financial causality. Unlike traditional economic theories, STF posits that waves of social mood—rather than external events—drive stock price trends. This theory offers a more robust, logical, and defensible approach to analyzing financial markets.

Challenging Conventional Wisdom

Prechter critically examines the Efficient Market Hypothesis (EMH), presenting compelling evidence that contradicts the notion that social events regulate financial markets. Through numerous real-world examples, he demonstrates how factors like interest rates, oil shocks, elections, inflation, and geopolitical events fail to consistently influence stock prices as EMH suggests.

Real-World Examples and Insights

Explore case studies that highlight the flaws in conventional market understanding. Learn why most investors make detrimental decisions during critical turning points, such as buying real estate in 2007 or oil in 2014. Prechter illustrates how a minority of savvy investors successfully anticipate these trend changes by leveraging socionomic insights.

Benefits of Adopting STF in Your Investment Strategy

By embracing Socionomic Theory of Finance, you can:

- Anticipate Social Trends: Identify and act on social mood shifts before they become apparent to the broader market.

- Separate from the Herd: Avoid common pitfalls by making informed decisions based on robust social data.

- Enhance Financial Security: Protect your portfolio and capitalize on opportunities by understanding the true drivers of market movements.

Bonus Feature: Financial-Economic Continuum Presentation

As an exclusive bonus, receive Prechter’s 17-minute presentation, “The Financial-Economic Continuum,” from the 2015 Social Mood Conference. This high-quality video explores the spectrum of markets, differentiating between speculative and utilitarian markets, and offers insights into various market dynamics such as shelter vs. real estate and food vs. commodities.

Who Is Robert R. Prechter?

Robert R. Prechter is the Founder and President of Elliott Wave International (EWI). Since 1979, Prechter has been a pivotal figure in financial analysis, enhancing R.N. Elliott’s fractal Wave Principle. He is the author of 18 books, including a New York Times bestseller, and has developed the influential socionomic theory, which emphasizes that social moods shape events rather than the other way around.

FAQs:

This theory says that financial markets work differently from other markets because they are based on what groups of people feel, rather than clear-cut economic facts. Markets move based on people’s moods and feelings about the future, which affects their investment decisions

Unlike traditional theories, socionomics believes that it’s people’s changing moods that drive market changes, not economic events or market news. This idea suggests that if you can understand and predict people’s moods, you can better predict market movements

Yes, Robert Prechter believes that by studying patterns in how people feel, you can foresee market trends before they happen. This method aims to spot market changes that other models might miss

Elliott Wave International offers books, online courses, and in-depth lessons on how socionomics can be used to forecast financial markets

You can buy the book from Elliott Wave International. They sometimes offer free chapters or videos on their website, and you can also get it as part of a subscription deal for financial forecasts.

Conclusion

Embrace a new era of financial analysis with Robert Prechter’s Socionomic Theory of Finance. This presentation not only offers a compelling alternative to the Efficient Market Hypothesis but also equips you with the knowledge to navigate and thrive in the complex world of financial markets. Whether you’re an intermediate investor or a seasoned analyst, integrating socionomics into your strategy can significantly enhance your market understanding and investment success.

Q & A

Ask a question

Your question will be answered by a store representative or other customers.

Thank you for the question!

Your question has been received and will be answered soon. Please do not submit the same question again.

Error

An error occurred when saving your question. Please report it to the website administrator. Additional information:

Add an answer

Thank you for the answer!

Your answer has been received and will be published soon. Please do not submit the same answer again.

Error

An error occurred when saving your answer. Please report it to the website administrator. Additional information:

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet