Karla Dennis – Tax Reduction Strategy Program 2.0

$1,497.00 Original price was: $1,497.00.$79.00Current price is: $79.00.

Download Karla Dennis’ Tax Reduction Strategies Program 2.0 – Comprehensive Guide to Minimizing Your Taxes (6.76 GB). Join Karla Dennis’s Tax Reduction Strategy Program 2.0 to maximize your savings and minimize liabilities. Learn expert tax reduction techniques.

Tax Reduction Strategy Program 2.0 by Karla Dennis

Unlock Maximum Tax Savings with the Tax Reduction Strategy Program

Discover the ultimate Tax Reduction Strategy Program designed by renowned tax expert Karla Dennis. This comprehensive online training empowers you to significantly lower your tax bills permanently, without relying on expensive CPAs or bookkeepers. Whether you’re a seasoned business owner or just starting, this program equips you with the knowledge and tools to optimize your tax strategy effectively.

What Is a Tax Reduction Strategy Program?

A Tax Reduction Strategy Program is designed to help individuals and businesses minimize their tax liabilities legally. These programs often provide comprehensive plans, tools, and guidance to optimize financial situations concerning tax obligations. Here’s what such a program might include:

- Personalized Tax Planning:

- Assessment of Financial Situation: Analyzing income sources, expenses, investments, and other financial aspects.

- Tax Bracket Optimization: Strategies to stay within lower tax brackets to reduce overall tax rates.

- Deductions and Credits:

- Identifying Eligible Deductions: Helping clients take advantage of all possible deductions, such as home office, education, and medical expenses.

- Maximizing Tax Credits: Ensuring clients claim all applicable tax credits, which directly reduce the amount of tax owed.

- Investment Strategies:

- Tax-Advantaged Investments: Guidance on investing in retirement accounts, health savings accounts (HSAs), and other vehicles that offer tax benefits.

- Capital Gains Management: Strategies to minimize taxes on investments by timing the sale of assets.

- Business Tax Strategies:

- Entity Structuring: Advising on the best business structure (e.g., LLC, S-Corp) to optimize tax outcomes.

- Expense Management: Identifying business expenses that are deductible to reduce taxable income.

- Compliance and Reporting:

- Staying Updated: Keeping clients informed about the latest tax laws and regulations to ensure compliance.

- Accurate Filing: Assisting with the preparation and filing of tax returns to avoid errors and penalties.

- Long-Term Financial Planning:

- Estate Planning: Strategies to manage taxes related to inheritance and estate transfers.

- Retirement Planning: Ensuring that retirement plans are tax-efficient and align with long-term financial goals.

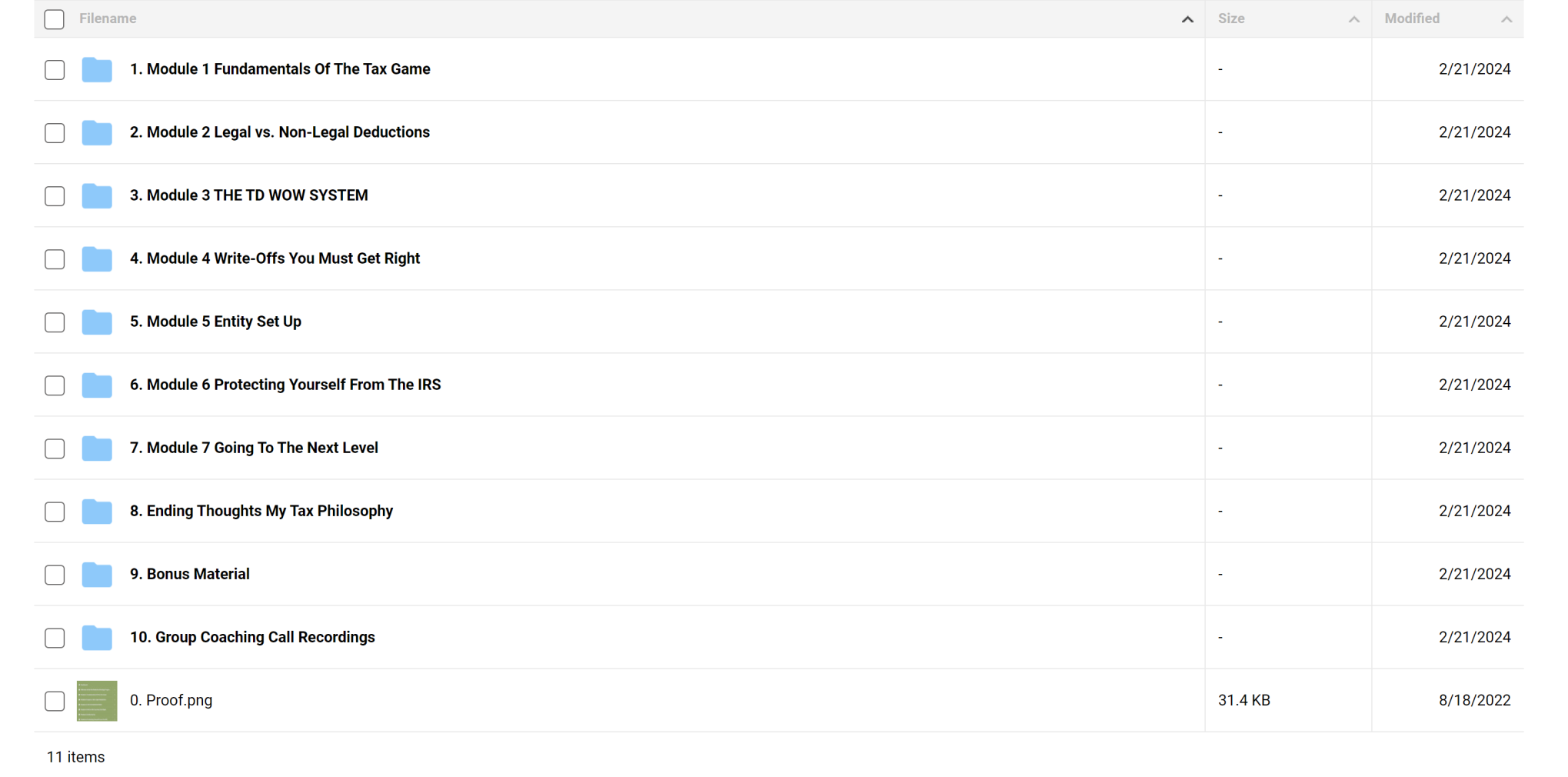

PROOF OF COURSE (6.76 GB)

Program Benefits: Maximize Your Tax Savings

After completing this Tax Reduction Strategy Program, you will:

- Permanently Lower Your Tax Bill: Implement strategies that reduce your taxes year after year.

- Gain Financial Independence: No longer depend on CPAs or bookkeepers for tax advice.

- Access Exclusive Frameworks: Utilize the same TD-Framework our clients pay $10,000 for.

- Optimize Business Entity Setup: Understand how to properly establish your business for maximum tax benefits.

- Audit-Proof Your Business: Follow a step-by-step plan to safeguard your business from IRS audits.

Who Should Enroll in the Tax Reduction Strategy Program?

This program is ideal for entrepreneurial-minded individuals who want to save money on their taxes. Whether you’re looking to start a business or optimize an existing one, this course addresses critical questions such as:

- Which business entity should I choose?

- What expenses can I legally write off as a business owner?

- How can I audit-proof my business?

If you aim to build a solid financial foundation and leverage the tax code to your advantage, the Tax Reduction Strategy Program is perfect for you.

What’s Included: Comprehensive Learning Materials

Enroll in the Tax Reduction Strategy Program and receive:

- 30 Detailed Training Lessons: A 6-week video series accessible anytime, anywhere.

- Physical Workbook: Implement what you learn with ease.

- Cheat Sheets & Resource Guides: Enhance your learning experience with additional materials.

Course Curriculum: Master the Tax Game

Module 1: Fundamentals Of The Tax Game

- The Simple Fundamentals

- Deductions And Write Offs

- TD WOW Tracking And Expense System

- Hobby Into A Business

Module 2: Legal Vs. Non Legal Deductions

- Legal Vs Non legal Write Offs

- Ordinary & Necessary Expenses

Module 3: TD WOW Framework System (9 Lessons)

- TD WOW Story Framework

- TD WOW – What

- TD WOW – Who

- TD WOW – Where

- TD WOW – Why

- TD WOW – When

- TD WOW – How

- TD WOW – Putting it all together

- TW WOW Story Examples

Module 4: Write Offs You Must Get Right

- Home Office

- Mileage – Getting out the most

- Medical Expenses

- Meals

- Tools

Module 5: Entity Set Up

- Fundamentals Of Entities

- How To Create An Entity

- Maintenance Of Entity

- Tax Considerations Of Your Entity

Module 6: Protecting Yourself From The IRS

- IRS Audit Defense And Offense

- What To Do In An Audit

Ending Thoughts: My Tax Philosophy

- Food For Thought

Exclusive Bonuses: Enhance Your Tax Strategy

Bonus #1: Karla In A Box: Done For You Taxes Training

In this 6-part video series I walk you through an easy to follow, step-by-step process on how to do taxes yourself. After you watch these videos you’ll know everything you need to know to file your tax return correctly. You’ll be confident knowing you’ll get all the money back you deserve.

Bonus #2: 22 Wealth Multipliers In The Trump Tax Plan

My team and I painstakingly combed through all 74,608 pages of the new U.S. tax code aka “The Trump Tax Plan” and put our findings in this report. We searched high and low and found 22 things everyday taxpayers can do to pay less taxes so they could keep more of their wealth.

Bonus #3: IRS Insider Secrets

This is an exclusive interview with the former IRS Revenue Officer, Mike Sullivan. In this video interview you’ll get a rare chance to see what the IRS looks for when they decide to audit people and how to protect yourself from one. You won’t find these secrets anywhere else!

Bonus #4: Creating A Million-Dollar Business

This is a great bonus for those who are starting a business, have a business or looking to grow a business. You’ll get all the resources I used to go from living in Compton to building a national multi-million dollar business. Includes resources on: mindset, marketing, leadership, sales, etc.

Bonus #5: How To Get Rent Checks from Government

Your tax dollars pay for each building being used by Congress, DOJ, NASA, CIA, FDA, and the White House. Therefore, you’re entitled to collect hefty “rent checks” from the government in the form of real estate investment trusts (REITS). I’ll show you where to find some of the top REITS to invest in that pay dividends at 12.55%, 8.16% and 6.43%. And how to get started!

Bonus #6: Help My Tax Person Guide

Most CPA’s and tax people just file your taxes, we call this tax compliance. They don’t try to leverage the tax code throughout the year to help you lower your tax bill. They aren’t taught that in school. So we give you an easy guide to help your tax person use the TD wow system to help you save on taxes yearly

Who Is Karla Dennis?

Karla Dennis is a highly acclaimed tax expert and business strategist featured in Forbes, MSNBC, KTLA, Yahoo! Finance, and SmartMoney. As an enrolled agent with a Master’s in Taxation and Business Development, Karla has authored two books, Tax Storm and Against the Odds. Through her consultancy firm, Karla Dennis & Associates™, she has saved clients thousands of dollars, establishing herself as the ultimate authority in tax reduction strategies.

Conclusion:

Don’t let the tax system dictate your financial success. Enroll in the Tax Reduction Strategy Program 2.0 by Karla Dennis today and take the first step towards significant tax savings and financial independence. Empower yourself with expert knowledge, actionable strategies, and exclusive resources to maximize your wealth and secure your business against IRS challenges. Join now and transform your approach to taxes forever!

Q & A

Ask a question

Your question will be answered by a store representative or other customers.

Thank you for the question!

Your question has been received and will be answered soon. Please do not submit the same question again.

Error

An error occurred when saving your question. Please report it to the website administrator. Additional information:

Add an answer

Thank you for the answer!

Your answer has been received and will be published soon. Please do not submit the same answer again.

Error

An error occurred when saving your answer. Please report it to the website administrator. Additional information:

Related products

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Business & Sales

Reviews

There are no reviews yet