Tradingriot Bootcamp + Blueprint 3.0

$395.00 Original price was: $395.00.$14.00Current price is: $14.00.

Download Elevate Your Trading Skills with Tradingriot Bootcamp & Blueprint 3.0 (8.84 GB). Welcome to the Tradingriot Bootcamp and Blueprint 3.0, your ultimate guide to mastering the complexities of the market. Launched in 2020, Tradingriot has become a hub for traders seeking in-depth knowledge on price action, order flow, auction market theory, and effective strategy development.

Elevate Your Trading Skills with Tradingriot Bootcamp & Blueprint 3.0

Introduction to Trading Mastery

Welcome to the Tradingriot Bootcamp and Blueprint 3.0, your ultimate guide to mastering the complexities of the market. Launched in 2020, Tradingriot has become a hub for traders seeking in-depth knowledge on price action, order flow, auction market theory, and effective strategy development. This program is meticulously designed to cater to those who favor dynamic video content over traditional written material, ensuring a comprehensive learning experience.

What Is The Bootcamp?

The Bootcamp is tailored for individuals who are determined to delve deep into market mechanics. Unlike the Trading Blueprint, which offers a concise overview for intraday trading, the Bootcamp explores each concept with exceptional detail, presenting practical applications for both day trading and swing trading.

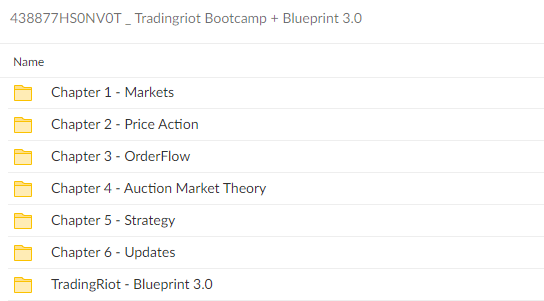

Download Proof | Tradingriot Bootcamp + Blueprint 3.0 ( 8.84 GB)

What Will You Discover?

- Advanced Market Insights: Gain a profound understanding of how markets operate through lessons on price action, order flow, and auction market theory.

- Strategic Development: Learn how to craft strategies using order flow and auction market theory tools, expanding your trading repertoire beyond day trading to include swing trading.

- Essential Trading Skills: Elevate your trading with modules on risk management, journaling, and daily preparation, crucial for long-term success.

Exclusive Access and Ongoing Support

Enrolling in the Tradingriot Bootcamp grants you access to 26 meticulously crafted videos, alongside a dedicated section for ongoing educational content, including trade breakdowns and market insights. Completion of the Bootcamp opens the door to personalized support, including email correspondence and one-on-one calls, to ensure your continued growth as a trader.

Investment and Incentives

The investment in your trading future is a one-time payment, with no hidden costs or recurring fees. Bootcamp participants will also join an exclusive community in the Tradingriot Discord, a space for discussions and idea exchange.

Special Offers:

- Blueprint Owners: Enjoy a 10% discount, automatically applied to your account.

- New Members: Gain complimentary access to the Trading Blueprint with your Bootcamp purchase.

Flexible Payment Options: Choose from traditional payment methods or opt for cryptocurrency transactions via Coinbase at checkout.

Begin Your Journey to Trading Excellence

Don’t miss this opportunity to transform your trading approach with the Tradingriot Bootcamp and Blueprint 3.0. For more information or to discuss payment options, please reach out via [email protected].

Tradingriot Bootcamp + Blueprint 3.0 Curriculum:

Chapter 1 – Markets

- Market Microstructure – bid-ask spread, order types, market participants, algorithmic trading, (42:14)

- exchange types

- Liquidity & Volume – anatomy of the order book, passive and active orderflow, understanding liquidity, how volume and liquidity influence markets, volume relativity (20:21)

- Understanding futures and choosing the right market – what makes a good market, what is the futures contract, index futures, bonds, commodities, currency futures, cryptocurrencies (22:06)

- Setting up trading platforms – covering sierra chart, exocharts and tradingview (38:20)

Chapter 2 – Price Action

- Price action principles – fractal nature of price, timeframes, efficient vs inefficient price moves, how price approaches the level (25:15)

- Key price structures – market environments, market structure, horizontal/vertical support and resistance, supply and demand, V-reversals, triple taps, compressions (21:18)

- Execution patterns – Cluster, Quasimodo, Failed swing (11:25)

- Bias determining candlestick patterns – Engulf, Failed Swing, Inside bar (10:41)

- Navigating timeframes and utilizing non-time based charts – non-time based charts, navigating timeframes (06:52)

Chapter 3 – Orderflow

- Understanding orderflow – the fallacy of orderflow, orderflow in different markets, passive and active orderflow, different tools for different trading styles (13:42)

- Delta and its indicators – what is delta? single bar delta, cumulative volume delta, y-axis delta (19:07)

- Footprint charts – what are footprint charts? usage of correct timeframe, bid/ask footprint, delta footprint, volume footprint, footprint statistics, trading patterns (18:46)

- Connecting orderflow to price action (22:57)

Chapter 4 – Auction market theory

- Auction market theory – what is AMT? key components of AMT, initiative and responsive activity, acceptance and failed auction, AMT rules (14:25)

- Market Profile – what is MP? Initial Balance, MP anomalies, day and opening types, composite profiles (26:39)

- Volume Profile – volume, what is volume profile? market vs volume profile, volumes in different markets, volume profile levels, mapping markets with composite structures (15:40)

- Volume indicators – relative volume and z-score, vwap, bar-to-bar POC (15:45)

- Connecting AMT with orderflow and price action (15:38)

Chapter 5 – Strategy

- Failed Swing (27:49)

- Cluster (24:18)

- Quasimodo (14:11)

- Risk Management (48:28)

- Intraday strategy (18:42)

- Medium-term swing strategy (14:13)

- Long term swing strategy (16:03)

- Trading Plan (25:22)

- Daily preparation (05:45)

- Journaling (08:38)

Total time: 9 hours 15 minutes

Updates – Section of new content coming for free to all Bootcamp owners

- Nuances of day trading crypto

- Revisiting cumulative volume delta

- Revisiting VWAP

- Setting up the ATAS platform

- How I trade FTX Move Contracts

- Expanded guide to swing trading

- Which type of Price Action do I use for entries, and which one do I avoid

- Finding profitable Altcoin trades using a data-based approach

- An in-depth breakdown of day trading

- Capturing large swings in price

- Trading “cheat sheet” – breaking down all the entry techniques, placing stops and targets. Unique to all timeframes approach.

- Execution

- Systematic aspects in trading

Q & A

Ask a question

Your question will be answered by a store representative or other customers.

Thank you for the question!

Your question has been received and will be answered soon. Please do not submit the same question again.

Error

An error occurred when saving your question. Please report it to the website administrator. Additional information:

Add an answer

Thank you for the answer!

Your answer has been received and will be published soon. Please do not submit the same answer again.

Error

An error occurred when saving your answer. Please report it to the website administrator. Additional information:

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet